|

|

|

July 1st, 2023 at 07:15 pm

Well, this year got knocked off track by Buffy's illness and passing :^(. Still feeling like the wind was knocked out of my sails. This next month is the lightest of the year at work and I have already arranged to take every Friday off, and hopefully I will both be able to make some progress on personal goals and get some R&R.

With regard to my 2023 Goals:

Health: Well, I lost weight from Buffy's diagnosis to passing, then gained it back. I'm currently at about 1 pound down from the beginning of the year. Exercise was going well until Buffy's passing and even for a bit after, but the combination of my overall sense of exhaustion after the stress of Buffy's illness with the record number of poor air quality days has put a dent into things recently. Working with the personal trainer twice a week, which I did from September until Buffy's diagnosis in March, was very helpful, but I'm still paying down the debt from Buffy's illness. I'm planning to get back to my regular "slogging" (very slow jogging) and join a nearby gym to work out on machines a couple of times a week just so that my muscles don't go to complete mush, then I'll go back to working out with the trainer again in the fall.

North Star goals:I tend to organize my life by major goals. Ever since 2009, the year that I left academia, (and my last long-term romantic relationship ended, and my mother and Henry the Pricey and Priceless Basset Hound were diagnosed with their terminal illnesses), the goal that served as my North Star was becoming a financial planner. Well, I've been one for nearly a decade now, putting the cap on that achievement with my official CFP certification 2 years ago this week. Then I turned to restoring my health as the major goal. Even though I gained a little weight back recently, I'm still down about 30 pounds from 2 years ago and even with the exercise slow-down, I can jog a mile and still do so a couple of times a week at least. I certainly need to continue on the health improvement path, but I've got some decent habits generally in place, and what's come in to view recently is planning for retirement as the next "North Star" goal to organize my long-term planning from now (about 7 weeks shy of 63) until age 70. And what *that* means is trying to focus more on finding a place to live in retirement (in my area; I don't plan to move away from here), getting ready to move, and focusing more on relationships and hobbies (as well as my health) so that I have built something to retire TO, not just to retire FROM. I'm a creature of habit, with my identity very (too much) tied to my work, so this too will be a long, slow process. [I just noticed that my 17-year Blogoversary was a bit over a week ago; any of you who have been with me since that 2006 time frame when a lot of us seem to have started here can see that transition in real time in my blog.]

Systems, habits, & routines: This is where I've gotten off track recently. My performance at work had improved before Buffy's illness, then slowed down again. But right now I have NO CLIENT MEETINGS scheduled for July, so it's my chance to catch up and get ahead. Although not much is on the calendar yet, it looks like August could end up being super-busy with as many as 16 meetings on the administrative assistant's "to schedule" list. Typically, I have 8-12 a month. Plus, we just adopted new tax-planning software at work, which I am trying to master ahead of everyone else since as the only CPA in the financial planner role in my firm, people look to me for support.

My big goal for July is to make some significant progress on decluttering my house. I have a houseguest arriving 5 weeks from today. Every year when she comes, I manage to get the surfaces cleaned off, so that the place is reasonably presentable. But every year the piles in my various storage spaces in the house just end up expanding. This year, I want to actually GET SOME OF THE EXCESS OUT of the house, rather than merely re-arranging it. Wish me luck!

My incentive for this: I'm not allowing myself to get another cat until I make some progress. Hopefully I can make decent progress during the next month, then adopt two new cats (my plan is to adopt a bonded pair of young adult cats) sometime this fall.

In the meantime, I probably spend several hours a week watching cat videos and missing my Buffy.

Posted in

Goals

|

1 Comments »

June 11th, 2023 at 08:50 pm

My net worth hit a new milestone (increment of 100k) this week. What with 2022's down market, it took a couple of years to get there. In a good market year like 2021, it currently takes just about a year to increase my net worth by 100k.

Debt is currently a bit higher due to Buffy's 3-month battle with cancer. I reshufffled around some of the debts this weekend and still expect to be able to reach my year-end goal barring (knock on wood) any big surprises.

One pleasant surprise was that I brought my car in for a repair 2 weeks ago, which I anticipated would cost me about $300, and it turned out to be covered under warranty. So I only had to pay for the oil change and tire rotation.

After getting my car fixed, I spent last weekend (Friday afternoon through Sunday morning) at a bed & breakfast that I like that sits along the Delaware River. It sits on "Scenic Drive," and there is a restaurant about half a mile away along the same road. There are also two small museums, the Zane Grey Museum and an exhibit about the Roebling Bridge, which was in some ways a prototype for the Brooklyn Bridge, which is also along this road. Scenic Drive is about a mile or so long, and at one end there is Veteran's Park, which has a jogging loop. So I walked and jogged, visited the two small museums, and did a lot of porch sitting (or sitting inside the dining room at a table with a view of the river when it was too cold to sit outside). I had dinner both nights at the nearby restaurant, and the B&B had a microwave and mini-fridge available for guests, so lunchs were freeze-dried reconstituted meals and fruit. This was a lovely period of decompression after the stress of the past few months, but I could use longer!

Then the middle of this week was marred by the horrid smoke-filled skies from the fires in Canada. For about two hours on Wednesday, my town had the questionable distinction of having the worst air in the country. I monitored airnow.gov until we temporarily got back to "good" air; now we are back to "moderate." Living in a valley, our area tends to collect smoke and allergens. I also ordered two new air purifiers, one for each story of my house. I figure bad weather events are just going to get more common in the future, and with my asthma, my lungs are a weak spot.

I've started on my decluttering project. At the beginning of the year, I had stated this as one of my goals for the year, but Buffy's illness put that on hold. This weekend I started by taking two big tote bags of cat food and two cat carriers (the ones that Buffy and Bridget arrived in in 2016) over to one of the local shelters to donate. I'm really going to try to focus on getting things cleared out over the next two months. I know that I'll only make limited progress, but hopefully I'll do more than the usual mere clearing off of surfaces and actually get some of the excess out of the house this year. The last time I took any photos of my house was in 2016, when my old college boyfriend stopped by for a visit. That was just before I started my current job, which has kept me busier than my last one, and the clutter has increased since then. This is my year to get things back to where I feel like I can have visitors again.

Posted in

Uncategorized

|

5 Comments »

May 21st, 2023 at 04:19 pm

I lost my beloved Buffy on Mother's Day. I took her to the emergency vet on Saturday morning for an issue which resolved itself while she was there, but they said, "while she's here, why don't we just do an x-ray and see if anything we don't know about is going on?" and they gave her a pain shot.

It was more intervention than she could tolerate and she was not the same cat when she got home. I waited 24 hours in case she improved--sometimes before after pain meds or being hospitalized, it took her 18 hours or so to get back to herself--but not only was she not herself, but she was hunching over (a sign of a cat in pain) and occasionally putting herself in her carrier to hide (a new behavior). She did drag herself out to the porch to lie in the sun for a while and I did get a few minutes of purring from her when I was lying by her side, but it seemed kinder to put an end to what was clearly suboptimal experience and the sooner the better. I tried to schedule an at-home euthanasia but the earliest I could get was Tuesday, and I didn't want to wait.

I have now been pet-less for a week, which is the longest period in 29 years. My head's intent is to adopt another two cats later this year, towards year-end, but who knows what my heart will end up doing? I'm still kind of numb and in shock and grieving profoundly. I have loved all of my pets, but there are some who touch you more deeply. A decade ago, Henry was my heart hound, and Buffy was my heart kitty for the past 9+ years.

Posted in

Henry, the Pricey and Priceless Hound

|

11 Comments »

April 13th, 2023 at 06:01 pm

My Buffy was diagnosed with lymphoma on March 9th. She started chemotherapy on March 17th. She had her fourth treatment this past Tuesday. According to the vet, it is typically the fourth treatment that puts them into remission.

We will see if she is in remission on April 25th and determine how to proceed based on that morning's ultrasound results. Either the chemotherapy will continue for another 3 months, but at increasingly spaced intervals, or the vet will determine that she is not responding and we decide how to keep her comfortable for the longest possible period (which would only be another 1-2 months at most).

The third chemo dose was particularly hard on her, but I learned some tricks after that--like making sure I have an anti-nausea drug and an appetite stimulant on hand, requesting subcutaneous fluids to be administered at home to make sure she is hydrated, adding Prednisolone and Denamarin (which contains milk thistle and helps the liver clear toxins). She will have that same drug on the 25th if we decide to proceed, but hopefully it will be managed better, plus I will know what to expect.

And if the results are not what I hope, I am steeling myself to not keep her around too long, just as long as her life seems to have quality most of the time. I've learned that one day of not eating might be followed by a good eating day, so I won't pull the trigger too early, either.

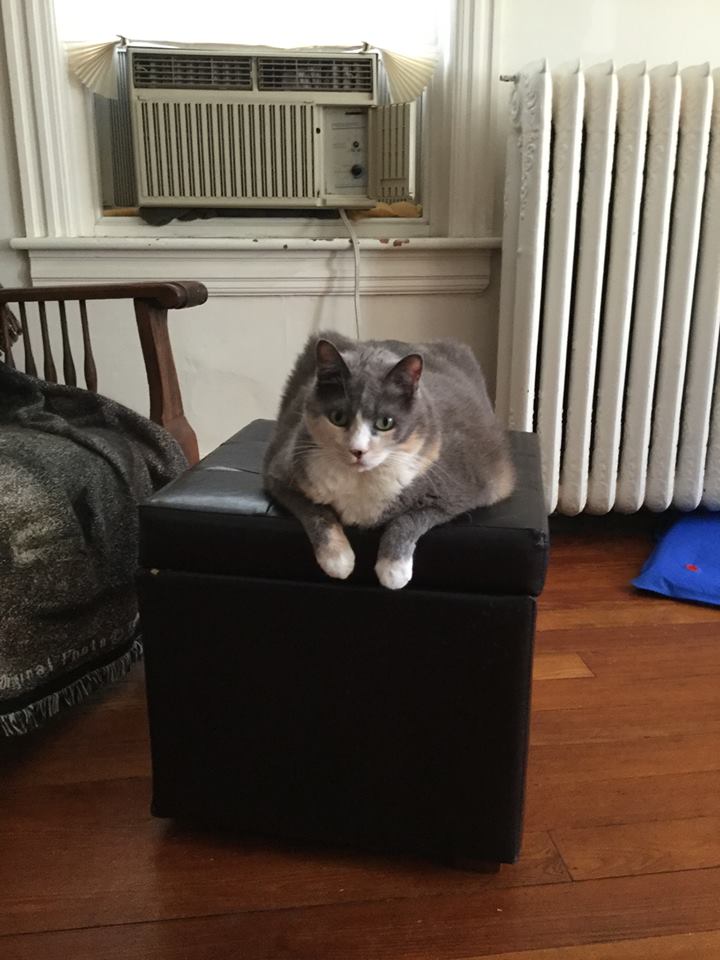

Photo from a couple of years ago:

Posted in

Henry, the Pricey and Priceless Hound

|

3 Comments »

March 10th, 2023 at 11:16 pm

Buffy, my kitty who turns 18 on the 30th, was diagnosed with lymphoma yesterday.

The two veterinary oncologists at my local clinic are booked out for the next 6 weeks so we have a consult with a veterinary oncologist next Friday at a clinic 70 miles away. (This will incidentally be the furthest I have driven since before the pandemic. I kinda stopped driving distances back then.)

I believe that the chemo can be administered locally.

It's intestinal lymphoma and I think it's the large cell variety, which has the better prognosis. I'm praying that we are just dealing with a 3-month course of chemo and then remission (although they never say that kitty lymphoma is cured). Some varieties of cat lymphoma have a 2-3 year prognosis with chemo, and that is about how long I would expect her to live anyways.

She is my miracle kitty who was expected to die back in 2019 when she was hospitalized for 10 days. She's been consulting the internal medicine specialist quarterly since then, so we caught this relatively early. She did not have enlarged lymph nodes at her last check on 12/5. Also her bloodwork is normal except for somewhat elevated neutraphils.

Yesterday when I went to pick her up, there was a Basset Hound named Albert in the waiting room. Bassets are my "spirit animal" and seeing one felt like a good luck charm to me. I pray it is.

I know that she doesn't have a long life span remaining in any case, but I've been walking around with a hard knot in the pit of my stomach since hearing the news yesterday. If her lymphoma turns out to be more agressive, she could be gone in 4 to 8 weeks. So I'm praying for longer with her than that.

Posted in

Henry, the Pricey and Priceless Hound

|

7 Comments »

February 28th, 2023 at 11:19 pm

My company pays our year-end bonus for the prior year in the second paycheck of February--if we get a year-end bonus. Bonuses are company-wide and based on whether the company met its profit-margin goal. Most years, but not every year, we get a bonus, and the bonus is the same (in terms of % of salary) for everyone.

The 2022 bonus was 15% of 2022 pay. I'm using the extra to pay down some debt. I'm still in process of that, since some payments hit my accounts automatically this coming week. Even with what I paid out today, my debts are now the lowest they have been since I began tracking back in 2006, when my debt was my mortgage plus 5k on credit cards. My total debt is down about 15k since the end of 2021.

I also got a merit increase, which will show up in my next check, of 6%, which was at the top end of pay raises given.

For the moment, I'll use the extra to either pay down debt or build up cash savings rather than contributing more to my retirement account. I'm currently contributing 20% of my pay to my retirement, 10% to the traditional/tax-deferred option and 10% to the Roth option. The dollar amount will increase because my pay is increasing.

I'm still not ready to declare myself "financially independent," but it's a step in the right direction.

Posted in

$$ balances

|

3 Comments »

January 1st, 2023 at 11:18 pm

Time for a fresh start!

I've updated my goals in my sidebar for 2023.

Here are results for 2022 and thoughts for 2023:

Health: I lost weight during the first 3 quarters of the year but regained 8 pounds during the last quarter, so need to lose that again. I was pretty consistent with activity and came just shy of my goal of 4 miles on average per day (based on total step count), for an average of 3.89 miles daily and 1,422 miles for the year. I'm aiming for 1,500 miles in 2023, just a slight increase. However, one of 2022's gains was that I started jogging, so I'm focusing more on intensity rather than just distance. I want to continue the jogging and might try a 5k this fall. I also started working out twice a week with a personal trainer back in September and that has also helped improve my fitness. I'll continue the one on one sessions for at least another quarter and might try moving to a group class later in the year to save $. But for now, the fact that I'm working myself harder than I would EVER work out on my own WITHOUT injury is enough to keep me with the one on one sessions.

Wealth: Overall net worth is down about 18k due to the markets. Debt down about 4k for the year. I changed my retirement savings strategy slightly: instead of saving 22% of my salary, with all of the savings going to the regular 401(k), I reduced my savings to 20% of my salary, with 10% going to the traditional 401(k) and 10% going to the Roth option. Since I expect to be in the 25% tax bracket in retirement, the after-tax effect is a net increase to after-tax retirement savings. I will look at this again once we get our annual salary adjustments, which are announced in February and take effect in March.

Systems, Habits, & Routines I didn't make much progress here OTHER than in the regular exercise habit, so I'm stepping up the priority for 2023. I'm spending my break doing some decluttering, which I want to be a bigger focus for 2023. The goal is to spend 2 hours each weekend day tackling a task--that's over 100 hours during the year.

Over the holiday, I completely emptied out my freezer, refrigerator, top of the refrigerator, and microwave cart and steam cleaned the refrigerator and microwave before restocking the refrigertor and freezer. Then tonight I'll be cleaning out my 2021 annual files to make room for 2023. I bought an accordian file for any 2021 paperwork that I want to keep in archives, such as correspondence received (tax information is stored separately). (I use the Freedom Filer system (https://www.freedomfiler.com/pages/filing-system-demos) with a 24-month purging cycle.)

I'm starting by tackling the low-hanging fruit, but I'm also planning to allocate some money and time over the summer to hire help to make some more rapid progress. Each year, I have a friend who visits over the summer and I take a couple of days off and get the most-used rooms of my house presentable for my guest, but each year, the clutter resurfaces because I'm doing more moving things around rather than moving them OUT. I have two major storage areas in my house, the spare bedroom and the basement, and I end up just moving more stuff in there rather than moving it out of the house altogether. This year, I'd like to move stuff OUT of the spare bedroom to make it an actual usable room rather than a storage area. I have a friend who's living on disability and what she can make from selling things at flea markets when she feels well enough. In the spring, I will see if she can sell some stuff for me (and she can keep the proceeds for her trouble). For anything she doesn't think she can sell, it'll be worth it to me to hire one of those services like Dr. Clutter to move stuff out. For the moment, I'm piling stuff in the basement and then when the weather warms up, I'll actually move it out of the house.

Posted in

Goals,

Fitness

|

8 Comments »

October 23rd, 2022 at 08:50 pm

I haven't blogged here in about two months, so just some quick updates focused on changes since my last blog post.

1. Changes to retirement plan contributions: I made a change to my retirement plan contributions. I had been contributing 20% to my 401(k) and 3% to my Roth 401(k). I changed the total contribution to just 20%, but now it is 10% to the traditional 401(k) and 10% to the Roth 401(k). That increases my Roth balance and gives me about $50 more cash to spend each month. I will reassess next year after we get our annual pay adjustments.

2. Personal trainer: After losing weight pretty steadily for a year (32 pounds), I came to a plateau. I know that one of the elements that has been missing in my health routine has been regular strength training. I had joined Planet Fitness to address this, but the trainer that I was working with there had some health problems of his own and missed appointments plus I got bored with it after about 6 weeks. I haven't yet canceled but what I did do was to find a personal trainer at a Cross-Fit gym near my house and I am working out with her twice a week. This isn't cheap but I'm learning more about form and I am being pushed beyond what I would do on my own. In addition to a Cross-Fit certification, my trainer also works as a Physical Therapy Assistant at the local hospital, so I feel reassured that she has good credentials and won't push me in a way that will lead to any injury. Plus, I just relate so much better to a woman trainer than to a man. I did lose another couple of pounds off my plateau after starting with her. At the moment, I've gained those back temporarily as we just had our company retreat this week, which threw my schedule and eating totally off, but 3 separate people who hadn't seen me since July noted that I *looked* thinner since they last saw me, so I'll take that.

Looking at my 2022 goal, I can see that I'm close on my step count to my goal of 9,500 steps a day on average--the current average since 1/1 is 9,471. I'm sure I can increase that by at least 29 steps by year end (maybe even by 529 steps).

3. Work--We had our annual company retreat, here in Pennsylvania. Usually the PA team travels to our company's main office in Richond VA, but this time, the VA crew came here, which I enjoyed. We spent part of our time at our company office but we also went to a lovely retreat center in the woods for half a day, which was inspiring.

The tax "extension" deadline is passed, thank goodness. I had a 396-page draft of a tax return dropped on my desk on Wednesday the 12th to review, then the 392-page revision arrived Thursday evening. I have a little bit of a break before the year-end planning gets heavy. And my calendar always gets filled up with meetings towards year-end. November will be a pretty busy month.

4. Wealth: Obviously with the markets down, it's not been a good year for my portfolio balances. Debt is a little higher than I would like, but in general moving in the right direction. I have been fortunate (knock on wood!!!) that I've been able to avoid big veterinary, car repair, or home repair bills this year. Also I haven't yet replaced the refrigerator or dryer, as I'd intended. So far they are each holding up.

Posted in

Goals,

Fitness

|

4 Comments »

August 28th, 2022 at 08:00 pm

My birthday was this past week. As a single person, my birthday and Thanksgiving are the two ostensibly celebratory days of the year that I usually dread most--the days where you "expect" to be with others who care about you (but if you are single, you might not be). But this year was actually a relatively good birthday.

When I opened the door that morning, my mail from the previous day was in the mailbox and included a watercolor painting of my cat Buffy done by a friend of mine. I didn't even know she painted. It's lovely, and I will frame it.

I worked that day, and in fact had 3 client meetings (which is about as many client meetings as I will ever have in a day), so the day was busy. But the birthday actually began the Friday before with the arrival of a mystery gift at my door which arrived without a card. I was able to trace the sender by posting a picture of the gift on Facebook--it was my friend who had come to visit me at the beginning of August.

Then when I arrived at work, there was a birthday card on my desk, and all of my coworkers greeted me with birthday wishes. One of my colleagues even sang to me!

After work, my boss took the clients to dinner and invited me. I was again serenaded.

Then the next evening, four of my personal friends took me to dinner at my favorite little Korean restaurant (where I am friends with the owner as well). I received an additional card and a couple of gifts, and the restaurant owner gave me an extra dinner to take home for the following night as a gift (I saved it and just ate it for Sunday lunch).

And of course, "Facebook" birthdays are fun since you hear from all kinds of people you never hear from the rest of the year. All in all, it was a pretty good day.

************************************************************************

Last week was super-busy as work, and Mon-Wed are this coming week, but I'm taking next Thursday and Friday off, and we have Labor Day off, so I'm looking ahead to a 5-day weekend. I took some time off in May but ended up spending a good chunk of it reading a textbook that I had long wanted to read. I'm very glad I finally got a chance to read that book, but reading and taking notes on a finance textbook is not exactly "R&R." Then the other long weekend that I took was right before my annual visitor came, and I spent two solid days working on decluttering and cleaning my house in preparation for her visit. Again, productive but not restful.

So this coming weekend, I am determined to use the time for more relaxing pursuits. I've scheduled a kayaking lesson (which includes the boat rental) through the nearby LL Bean outlet, which runs classes at a lake 20 miles south. I'll probably schedule one or two social things, but mostly I want to leave time for reading, walking, and taking a nap or two.

Posted in

Uncategorized

|

8 Comments »

July 23rd, 2022 at 09:19 pm

Sometimes things at work calm down for both July and August, but this year, August is getting pretty booked, so it looks as though July is basically my summer "down" time, and I'm really only realizing this as it is drawing to a close.

I do have several more PTO days I can take this year; just need to figure out a reasonable way to schedule them. Generally taking a 3-day weekend (or expanding a 3-day weekend into 4 days) works best for R&R. *Nothing* really seems to work for decluttering, other than my friend coming to visit once a year. Tomorrow and next weekend will thus be busy preparing to make my home less cluttered before her visit the first weekend of August. I DO intend to make decluttering a major focus for next year. I don't seem to be able to take on more than one major non-work goal at a time at the moment given limitations both of my work schedule and my energy levels, which are impacted by Hashimoto's even though my TSH levels are normal (even improved, all while the thyroid antibodies have worsened).

So "summer" means actually making more of an effort to see and do things with friends, seeing people maybe once a week rather than maybe once every six weeks. Now and the holidays are the only times most of my friends hear from me. I did call one of my friends today whom I haven't spoken to in a year or so; she told me that she turns 75 this fall and her husband turns 80, which is sort of startling since when we met, she was in her 40s and he was in his early 50s. Makes you realize how time flies.

As a single person and one of the few people in my local friend group who is not already retired, it means that I have to make an effort to reach out and arrange things--and these days, I generally don't have the energy that I did in my 40s and early 50s. Since most of my friends are retired, they usually get together for lunch or to see a matinee when I'm working. I'll have to make efforts to expand my friend group, but one thing at a time. Last year, CFP exam; this year, focus on health, next year, decluttering so I have a place I feel good about inviting people over to, and THEN a focus on the social.

I've had a few dinners with friends, including last night and tomorrow night. One of my friends owns my favorite local restaurant, so tomorrow night, I am going over to her restaurant (which is closed on Sundays) for a private dinner with her and her husband, and then we are going to see Where the Crawdads Sing at a nearby movie theatre--my first visit to a movie theatre since COVID began.

I also uses the summer time to catch up on doctor's visits. I still need to get glasses following my eye doctor visit back in May. And I had my annual primary care visit last week, generally all good news except mildly elevated LDL cholestorol, and then those TPO antibody numbers (which were based on a test that *I* ordered; he just ordered TSH and free T4). A couple of friends had suggested that I might try going on Levothyroxine at a low level to see if it would reduce the fatigue and brain fog, but my primary care doctor didn't want to do that since my TSH numbers are normal and even improved. I DID decide to change endocrinologists and will be seeing the Head of Endocrinology at the local hospital, who a friend recommended, but I'll have to wait until Oct. 25 to see him.

In the meantime, I realized that my increase in thyroid antibodies directly tracks with an increase in dairy consumption. I've decreased my carbs and increased protein to lose weight, and a lot of the increased protein has been one or two servings of Greek yogurt each day. So I decided to eliminate dairy and retest my antibodies in another 6 weeks.

Another summer experiment is that I just purchased a "Slack Block," a device for balance training. This is a purchase I have been toying with for a couple of years, and, after hearing my friend today talk about the balance problems that both she and her husband have, and having had 3 of my colleagues who still have living parents had a parent hospitalized this year after a fall, I've decided that it is better to start being proactive about this before I develop any problems. (I don't have any balance problems, but neither do I currently have the strength to stand up from the floor without using any hands whatsoever....at best, I can stand without putting a hand on the floor but I do need to brace a hand on my knee to stand up--and I can only do this on one side.)

Posted in

Goals,

Food

|

5 Comments »

July 6th, 2022 at 01:33 pm

I'm on my last day of a 5-day "weekend." The two major accomplishments are making some progress towards my continuing professional education requirements for the year (I need to average 40 hours a year, and had only completed 4 as of 6/30; 4 more added and another 6 in progress), and taking a concrete step on my health and fitness journey by deciding to join Planet Fitness.

I had been looking at two more expensive options (and I haven't ruled either out yet for a short period later), but I decided that Planet Fitness is an affordable place to start, and if I want additional help, I can add that on later.

There are two PF locations within 3 miles of me; I visited both on Sunday. One had slightly higher ratings on Yelp and I was initially leaning towards joining that location, but after visiting both, I ended up joining the other. It's only half a mile closer but the commute time each way is 5 minutes less and the parking lot is far, far nicer at the location I joined. It's a funny criterion, but parking in a "real" parking lot near the entry feels far nicer than parking in a vacant lot where you have to walk past a vacant store front to get to the gym entrance. I joined on Monday, worked out on the cardio machines, and then went back on Tuesday for the "formal" new member orientation and to meet with the club's trainer to set up a program.

Since I have more discretionary time during the next two months than I will during the rest of the year, I opted to start at the "black card" (higher cost membership) that allows you access to the "spa" area with hydromassagers, tanning boths, and a red light/vibration plate booth, as well as the ability to bring a friend. The plan is to keep this level for three months and then downgrade to the $10/month level for the rest of the year. I do have one friend who I haven't seen much the past few years who I think would go along with me to the gym and would help with reconnection. Our previous connections have mostly been on various fitness ventures, but she is far fitter than I, and a year ago, I injured myself trying to keep up with her, and since then, we haven't connected much. Plus the massagers are pleasant. I stopped having "real" massages after having a reaction to the oil used at the last massage I had, so this is a reasonable alternative.

I was surprised to find out that PF has *free* personal training. Every other gym I have belonged to, (and this is the 8th gym I have joined in this area during the past 30 years, and the 10th in my lifetime) you joined the gym and then the trainer tried to upsell you on personal coaching. But I met with the trainer yesterday and he told me that his services are free with your membership. So I am starting on a 3 times a week schedule meeting with him, focusing on strength training and learning proper form. I suspect I will only keep this up over the summer months, but hopefully it will give me momentum and confidence to keep going on my own afterwards.

And of course, hopefully I won't catch COVID by increasing my exposure this way. I will definitely have to start keeping greater track of case counts again now that I will have increased exposure risk.

First real training session tonight!

**************************************

Also, today FitBit rolled out a new feature, Sleep Profiles, which analyze your long-term sleep patterns over the course of a month. They have ten different metrics, which they then group into "sleep animals" to give you a sense of the overall pattern. I learned that I am a "hedgehog," which refers to a cycle where you fall asleep later and wake up earlier, leading to shorter sleep duration, and typically lower REM and deep sleep cycles. The more alarming part is seeing your comparison to the typical range and to the ideal. I'm in the ideal range on only 2 of 10 variables, bedtime (before 11:30) and time to fall asleep (20 minutes), and out of the typical range on the variability of my sleep schedule and my sleep duration (5 hours & 24 minutes). I like this because it gives me a concrete target to focus on in improving my sleep--getting to bed earlier more consistently. It will be interesting to see if I can make a dent in my long-term patterns in this area.

Posted in

Goals,

Fitness

|

5 Comments »

July 2nd, 2022 at 09:37 pm

We're over the hump and on the downswing for the year! Always a good time to stop and re-assess.

Financially, of course, my retirement plan balances have seen a decrease, counterbalanced somewhat by increases in the "comp" value of my home. We did get a bonus, which I used to pay down debt. As of 6/30, my assets are down 4.9% for the year (all due to retirement plan assets being down), my debts were down 10.6%, and overall, my net worth was down 6%.

But the key is really in the ratios. On 12/31, my debt to equity ratio was 10.71%, and now it is 9.8%. And my asset to liability ratio was 10.33, and now it is 11.3. Having gotten to a point where my debts (liabilities) are a much smaller portion of my net worth makes me feel like I have reached a tipping point, even if the absolute dollar value of my net worth is down a bit. [For reference, a decade ago, my debts were 23.4% of my net worth and my assets were 5.3 times my liabilities.]

Now we'll see what the second half of the year holds. The average bear market is nine months, and it's unlikely that we'll see the very sharp recovery that we saw after March 2020, so it's possible that the entire year will end up down compared to 12/31/2021--but I expect to meet and possibly even exceed my debt reduction goal, assuming (knock on wood!) no major veterinary expenses for Miss Buffy or big home/car repairs. So even if my retirement plan balance doesn't fully recover, I expect my debt to equity and asset to liability ratios to improve. I've got a 5 to 8 year period until I retire (and even after retirement, it is likely that I will work part of the year doing tax prep for at least a few years), and I expect all my current debt to be paid off by retirement, so I'm not too worried.

I walked (and jogged!) 1,757,874 steps during the first half of the year, exceeding my goal of walking at least 9,500 steps a day. I have not yet consistently added in strength and mobility training, so that is a goal for Q3. My weight is 13.8 pounds lower than at the beginning of the year (and 32 pounds lower than it was about a year ago, around the time I took the CFP exam). Increasing sleep remains elusive.

No progress on my estate plan yet; I will work on organizing things during July and August, which are my lightest months of the year at work.

Only slight progress on decluttering; that is another July/August project. As long as the old dryer and refrigerator are still working, I will hold off on replacing them.

I have off through Wednesday, so I'll have some time to work on some of these "personal" projects, but mostly I hope to get some rest.

Posted in

Goals,

Fitness

|

2 Comments »

May 14th, 2022 at 11:09 pm

I took the first week of May off of work to recover from tax season. Even though I no longer actually do tax preparation, as the CPA in our office, I do get extra work both at the end of the year and at the beginning of the year until tax day.

Because my kitty is 17 years old with medical conditions, I don't want to leave her if I don't have to (I will have to leave her for 2 days in June--just one overnight--for a required work trip), so I don't even think about going anywheres these days. I didn't even do any day trips--I've gotten out of the habit of driving and at the moment, anything longer than a 5 mile trip makes me a bit nervous).

I had plenty to do, though, mostly catching up with household stuff. I brought my car in for its 60,000 mile service, had my bicycle refurbished, did some decluttering, and caught up with a few friends I hadn't seen since the holidays. I also read a lot.

I went to services the last weekend for their first in-person potluck in two years, and, wouldn't you know, someone who was there tested postive for COVID the next day, so my first few days back at work were spent working remotely. I am fortunate that I did not come down with it.

Now things will be a little calmer at work until they rev up again in September. I'm going to try to make more of an effort to work fewer evenings and weekends during this relatively "slow" time of year.

Posted in

Uncategorized

|

1 Comments »

April 2nd, 2022 at 03:51 pm

It's been a very hectic quarter work-wise. I had 28% more meetings this year compared with last, plus more tax projections to do, and I am BURNED OUT. I have another horrid week this coming week but I am taking Thursday and Friday off. While generally I like my job, the thing that I dislike is that I have very little control over my schedule. Meetings get scheduled for me and are based first (of course) on the client's needs and second on the lead advisor's needs, and my needs are not taken into account (we don't use the term, but I am essentially a "sub-advisor.") I work with 3 lead advisors who don't really bother to coordinate with each other (even though we all can see each other's schedules)--it's on me to say, "wait a minute, I already have 5 meetings that week, please don't schedule any more for me" and I might or might not end up making a difference.

But things should calm down a lot from the second half of this month until September, at least.

As far as my goals--I *have* lost 3 inches off my waist and a solid 10 #s in Q1, getting close to 25 pounds overall since I started focusing on my health back in August after finishing the CFP exam. I haven't done the intermittant fasting yet this year, but I will probably get back to it once the weather gets warmer. I've been doing it on and off since 2016, and I always end up falling off the plan once the weather cools just as my schedule ramps up in the fall, and then I usually get back to it in the summer, when it's warmer and less hectic at work.

I walked 879,345 steps in Q1 per my FitBit, which is 9,770 steps a day, which slightly exceeds my goal. Strength training, though, has been minimal--I do some light weights and some TRX exercises rather sporadically. I'll focus on that for Q2 once I can get back to a gym.

I'm hoping that *this* is my year for weight loss and that I can take off (and KEEP OFF) at least another 30 pounds this year.

Wealth: Thanks to the bonus we got last month, I am actually within a hair's breadth of reaching my orignal year-end goal of 70k total debt, and I should reach that goal within the next month, so I'll hope to get the year-end total closer to 60k debt. After several years where I'd pay down debt and then have emergencies and incur more debt, I'm hoping that this debt reduction is "real."

Of course, my kitty just turned 17 this week, and there is always the possibility of major expenses for her, but I am knocking on wood that she stays stable. I spent last weekend going over to a friend's house twice daily to help her administer subcutaneous fluids to her cat and talking with her while she made the decision to put the cat down, so this is very salient right now.

No progress yet on systems/habits/and routines goals other than getting into the habit of regular exercise and logging my food. Will need to wrap my head around getting the household more organized but not until after I've had a break and am not longer feeling so wiped out.

Posted in

$$ balances,

Fitness

|

3 Comments »

February 27th, 2022 at 12:10 am

Filed my tax returns today; getting a bit of a refund. Also the paycheck with the bonus arrived in my account today (I didn't expect it until Monday but was very glad to have it early). I paid down some debt and am actually almost to my goal for the end of the year already (meaning that I will adjust that goal downwards).

I also am keeping aside a couple of thousand of the bonus & refund for the home/car repair and veterinary expenses that are bound to arise during the year, plus another few hundred to either repair my bicycle or buy a new one. Will be taking the old bicycle to the shop in the next week or so to get an estimate of cost to refurbish it. It's 30+ years old but they don't make frames like they used to--this one is sturdier, so it IS a bit heavier, but it's not *that* much heavier than a similar bike manufactured today.

Looking forward to a time when I will have time to ride it--even though I don't do tax prep any more, my work load early in the year is always disproportionately busy.

Posted in

Uncategorized

|

1 Comments »

February 24th, 2022 at 02:13 am

Our company gives out bonuses--if any--last year there was not--at the end of February. Bonuses are the same throughout the company and are based on our firm meeting its target profit margin for the year. We did, so this year, we all got a 15% bonus--one of the largest in the time I've been with the company.

This time of year is also when merit increases in pay are announced. I got a 7.5% increase--not my highest, but still one of the top increases percentage wise. This will take effect with my March 15th paycheck.

We had the option to change our 401(k) elective deferral for our 2/28 paycheck (which includes the bonus). i usually contribute 22% of my pay to my 401(k), but for 2/28, I will contribute nothing so that I have have the maximum amount available after tax to pay down some debt. After the debt is paid off, I should be close to my target for the year--whch of course means setting a new target for 12/31. I've really been focused on paying off debt for the past 2 years and it is coming down nicely, although it's still a ways from being paid off. But I think in about another year of dedicated debt paydown, I will get rid of most of the non-mortgage debt, and the mortgage is coming down nicely as well. It would be paid off in less than 8 years if I paid no more than the minimum required payment, but I usually pay some extra, so it should be paid off sometime between 2025 and 2027, which means it should be paid off before I retire, which is the goal.

I won't use all of the bonus to pay down debt, though--I'll be leaving about a third as a sinking fund for upcoming expenses like home and car repairs and veterinary bills. And I might use about $700 or so to buy a new bicycle or otherwise do something that I can use to improve my health.

Posted in

Uncategorized

|

7 Comments »

January 1st, 2022 at 11:12 pm

Assets up 13.6%

Debts down 2.7%

Net Worth up 15.7%.

Steps walked: 2,602,440, which is 7,130 on average per day, and 1,097 miles in total (3 per day on average).

Dollarwise, this is about $104k increase in assets, $2.5k decrease in debt, and $106.5k overall increase in net worth, the first year in which the increase has been over $100k.

Debt reduction was slower than hoped for because of a number of large expenses, particularly for home repairs and maintenance plus vet bills when I lost Bridget back in April.

I've been in my 106-year-old house for 16 years, so appliances that had been replaced shortly before I bought the house are reaching the 20-year mark and are beginning to break down. I'm seriously contemplating replacing the refrigerator, dryer, and oven (especially the refrigerator, given remaining supply-chain delays) before they actually break down. Then the only major system that I would not have replaced (I think) would be the furnace, which I do have maintained annually (reminder--time to schedule this!). Over the past 2 years, I've done the roof, hot water heater, and washing machine plus a lot of plumbing upgrades. I might look at January sales for the refrigerator and wait and see whether and how much we get for a bonus before deciding on the oven and dryer.

Had a very quiet New Year's Eve--went to bed early, woke up and talked to my sister on the west coast around 10pm and then lights out. This morning, I joined a walking group and did 2 miles of a group walk in the rain.

My "theme" or "word for the year" for 2022 is "Foundations." I want to rebuild and shore up my foundations and regroup after finally completing the CFP designation in 2021 before deciding what my next "stretch goal" might be.

I'll have 3 areas of focus: Health, Wealth, and Systems, Habits, and Routines.

Goals within these are as follows:

1. Health: Losing at least 3" off my waist is the primary goal. To do this, I will try to fast at least 14 (preferably 16) hours daily and try to eat a diet that is 80% unprocessed foods. I want to figure out a way to get more sleep more consistently, more than 6 hours (7 ideal). I'm going to challenge myself to increase the daily step count average to about 9,500, which would be 4 miles a day. Adding in two strength training sessions per week is the last sub-goal here.

2. Wealth: Continue to save, and to pay down debt to 70k or less. Get estate plan in place.

3. Systems, habits, and routines: Improve workflow to get tasks completed earlier. Refine Morning, Evening, Work Start-up and Work Shut-down routines. Make intermittant fasting and 10k steps/daily exercise habits (i.e., done w/o thinking and developing an intrinsic desire to do so when I lapse.) Systematize reading/note-taking/note-making processes. Develop daily habits for meditation, reading, and journaling that are part of my morning or evening routines.

Finally, I want to think during the year about what my goals for 2023 and beyond might be. I see 2022 as a year of regrouping after putting most of my efforts into my new career during 2009 to 2021. The next several years are more of a preparation for retirement--which I still think will be several years away--but I would like to expand my social circles once the pandemic has died down and focus somewhat more on avocational interests. One of those "avocational" interests is to do some writing that integrates ideas from my two areas of professional expertise. But for now, regrouping in order to refocus my energies is enough.

Posted in

Goals

|

2 Comments »

December 26th, 2021 at 05:22 pm

My company often gives us a bonus if we meet our revenue goal for the year. They announced at the monthly company meeting earlier this month that we had met it, so I am very optimistic that we will be getting a bonus.

This used to occur at year-end, but a couple of years ago, they changed it to giving it out at the end of February so that the books could be formally closed for the year before they figured the percent that they would use (the bonus is typically some percentage of your base salary). In past years that we've gotten a bonus, the percentage has been 10% or 20%, but that was before they increased everyone's base salary by 20% at the beginning of 2020, so I'm not sure what percent bonus to expect. There was no bonus in 2020 and, with higher base salaries, the percentages for bonuses are likely to be lower.

If we get 10%, I'll be able to wipe out one of my debts completely. Then in January of 2023 (bonus or no bonus) I will be able to wipe out a second debt (0% balance transfer credit card), and that will bring my debts down to my mortgage, a HELOC, and one other loan (plus monthly credit card debt that is paid off) by early 2023.

I don't think I'm going to have all of my debt paid off by the end of 2025 as I had once hoped, but if we get a couple of additional bonuses between now and then, it's still possible.

By January, my debts should be less than 10% of my net worth, and my assets about 11.5 times my net worth, which is a big improvement from 5 years ago, when my debts were over 20% of my net worth and my assets were 5.6 times my net worth.

My retirement assets are at about 8x my annual income, which is still too low to retire (ideally you have your retirement assets at least 10x your annual income, or better yet at 12x your income or more), but, as less of my income will need to be devoted to debt reduction by 2023 (assuming no more really major debts--I'm already assuming there will be some fairly large veterinary bills and capital expenditures), I should get to "retirement-range" assets (10x income) by my mid-60s (I'm 61) assuming that we don't have a protracted slump in the markets. (I'll be looking at my allocations during this next week that I have off and considering how much more conservative I want to get--I remain at about a 60/40 allocation overall). I'm currently saving 22% of my income to my 401(k), and getting another 3% contribution from my company. Any additional savings will be put into conservative investments in a taxable account because I need to increase my liquid reserves. I was also really happy to see that my retirement savings from my current job (which I have been at for 5 years and 2 months) are at about 106k even before the 12/31 contributions.

Posted in

Uncategorized

|

1 Comments »

December 21st, 2021 at 11:53 pm

I had accumulated time off that I needed to take, and it worked out to be able to take it at year end, so I am officially OFF until January 3rd!

It's kind of scary, actually. When I work, I don't really have to think about what to do with my time. The to-do list is longer than can be accomplished but the priorities are clear. There are invariably lower-priority things that *Don't* get done, so now I have to figure out which of *those* I want to accomplish.

The big goal for year end is always doing a year-end review and planning for the year ahead. I've already started doing some of that.

In 2021, I did manage to complete a long-term "big" goal of attaining my CFP certification, so that gets moved off of the list. I've decided that my 2022 "word of the year" is "Foundation," with a focus on physical foundations, specifically health and home decluttering.

I actually started the health project right after completing the CFP, and (working with a health coach) I've become much more consistent about exercising. When I look at my Fitbit graphs you ca see that, from January thru July (when I took the CFP exam, I was averaging somewhere between 5 and 18 "active zone" minutes per day. My activity level ramped up during August and I've averaged over 30 minutes a day from September on. I even have managed to jog a non-stop mile a couple of times so far--something that I hadn't done in over a decade.

I'm happy about my exercise progress and want to continue that, and build up more of a strength component, but during the new year I also want to see if I can make some progress on my weight (or, as my coach encourages me to call it, "body composition," a less loaded term). I just finished reading a book, "Burn," by Hermann Pontzer, that makes a really strong case against the "Calories in/Calories out" model. Our bodies are so good at adapting to our exercise activity that increasing it doesn't really make any difference in your weight, unless it's in the very short term. Losing weight needs to be really all about food, and particularly about eating "real" (that is, minimally processed food (though cooking the food is fine--this is not about a raw diet.) I'll also be going back to my 16:8 intermittent fasting schedule as often as I can, since I can often stick with that, and will try to add in daily "fasted movement" before breakfast and a post-prandial walk after dinner as often as I can. I'll actually be working with two health coaches during Q1 of 2022--one, who ran a free 7-day challenge this past month, who is really good at focusing on the day-to-day granular entries and who is more of an expert in nutrition and exercise physiology, and the other, the one who I've been working with since August, who is more of a "mindset" coach and is all about the big picture. So the first big goal for Q1 of 2022 is to keep up the exercise consistency and tweak my nutrition plan with the goal of taking off 3" off my waist (which would be about 20 pounds). That would be lower than anything that I have weighed since 2000.

I also have a goal during 2022 to start decluttering my house. I want to make a *start* at this during my break, but I'm giving myself the whole year to make some progress. The big goal during break is to 1. clear off my dining room table and file/toss the recent mail (bad habit of mine; bills always get paid on time but organizing things only gets done sporadically); 2. get the old bed out of the bedroom since I have been happily sleeping on my shikifuton on the floor for over a month now; and 3. if I can, clear out some of the unworn clothes from my closet, clear out the bathroom cabinet, and clear out the kitchen cabinets and refrigerator.

Because I'm staying close to home so I can be with my Buffy cat, I have no plans to travel, but I hope to fit in a few meals with friends I haven't seen (provided the pandemic doesn't get too crazy). Otherwise I mostly just hope to unwind and rest up for the busy year ahead--I have to hit the ground running on January 3 and it will be very busy during Q1.

Happy holidays, everyone!

Posted in

Uncategorized

|

5 Comments »

November 13th, 2021 at 08:46 pm

The bed that I have been sleeping on for the past 21 years was purchased for me (by a friend using my credit card) when I was in the hospital having had major abdominal surgery, a 10.5" incision. (They now do the same surgery laproscopically). For the 18 years prior to that, I had slept on a futon on the floor. For the past year and a half or so, I have been debating replacing the bed as it doesn't feel as supportive as it had previously. I had been thinking to wait until January to move the expense into the new year as this year has been a costly one already in terms of home expenses, but after a couple of successive poor night's sleep and coming up on my busy time of year, I decided not to wait.

I also decided to go back to sleeping on a futon on the floor for better support and because I just prefer it--especially since I always have one or more "fur-kids" and they often sleep with me. Actually when I had my last Basset Hound Henry, once he became ill, I slept on a foam pad in my living room for about a year and a half because he couldn't get upstairs where the bed was and we both felt better when I was near him.

So I bought a Japanese-style futon, although this one is 4" thick rather than the traditional Japanese 3" thick and it is the size of a twin bed rather than the smaller traditional Japanese dimensions. I've slept on it 3 nights so far and so far so good in terms of how I'm sleeping. Since this was delivered by Fed-Ex and left in a box at my door, I still need to get rid of the old bed. A friend is going to come over next weekend and help me deconstruct the old bed so I can put it out in the trash. I've never done this before but she has. I remember when they moved the bed INTO my house, they needed to take out the window because a full-size boxspring would not make it up the narrow stairs (with turns at two small landings) of my hundred-year old house. I'm glad that the window won't have to be removed from the frame again in order to get the old bed out!

Getting rid of the old bed will be step one of decluttering. In other news, because my firm very kindly counted the week that I took off to study before the CFP exam as work time rather than as vacation time, I found that I had 8 days of vacation time accrued (with another 3 days still to accrue by the end of the year (as of 11/1), so I'm taking off next Friday and then from December 22 to December 31. With weekends, that will give me a 12-day stretch away from the office. Since Miss Buffy was hospitalized back in 2019, I've not gone away from home overnight and I've taken my vacation time as a series of long weekends. The problem with that is that I never get any larger projects done around the house. A long weekend is time enough to catch up on rest and to do something fun and catch up on the household chores, but there never is time for any larger household projects, so they just accrue. I really want to make some progress decluttering over the next year and this will be time enough to pick at least one of the larger projects and just do it. I'm going to start with the kitchen over Thanksgiving weekend and maybe I can get that decluttered then and use the time at the end of the year to turn an upstairs bedroom from "the storage room" to a home library/study/gym (which is what it was when I first moved in, before I decided to change careers).

Posted in

Uncategorized

|

2 Comments »

October 30th, 2021 at 04:59 pm

I found a particularly useful article on where you should be in terms of your retirement savings (assuming you are still in the accumulation years) at https://www.troweprice.com/personal-investing/resources/insights/are-my-retirement-savings-on-track.html.

I like this article because they don't just give you a multiple of your income by age, but they also split it out by marital status. Further, if you are behind, they also give you a percentage of your income to save that is needed to catch up.

For example, my retirement savings are currently at 8x my income. At my age (61) and income, it should be about 8.5 to 9x my income. I'm behind because I lost several years of savings due to making a major career change and having some very low income years from 2009 to 2014 when I didn't add to my retirement accounts. The chart says that in order to catch up, I should be saving at least 13% of my income. I currently contribute 22% (and my employer contributes another 3%), so that is reassuring about catching up to where I should be.

My debt continues to decrease but more slowly than I'd like as this year involved replacing a number of things in the house that are breaking down now that I've been here (today is my 16 year anniversary of home ownership). This year it's been the hot water heater, washing machine, and some major plumbing (plus veterinary expenses associated with my cat Bridget's illness and passing). Next year I'll probably replace the dryer, refrigerator, and my bed, and possibly the range. (I've been living without a working range for 2 years now and getting along fine with an Instant Pot, Air Fryer, and coffee maker but the house should have one.) I know appliances go on sale in January so I may shop the sales then. I'm particularly worried about the refrigerator going on me and I hope that I replace it before it just goes, especially given the current supply chain problems and delivery delays.

Posted in

Uncategorized

|

0 Comments »

October 19th, 2021 at 10:59 pm

I called the Porting Department of Consumer Cellular directly, since the last Customer Service Rep gave me their number after about 4 previous calls. Once I reached the representative, he was able to conference me in to his call with Tracfone. They sent me a code to verify my current phone and then they released my number and they at long last were able to port my phone number over. I just tested it from my work phone and the new iPhone rings when you call my number. At long last, success!

Now I have to copy all of my old contacts over manually. My dumb phone is so old there is no easy way to transfer--I spent about 45 minutes a while ago copying all of the phone numbers I had in there and I need to make sure that they are in my contacts. I think my gmail contacts are already in there but a lot of the phone numbers I call most often--like my work colleagues--are not in the gmail but just in the old phone.

Very relieved this is done!

Posted in

Uncategorized

|

2 Comments »

October 19th, 2021 at 12:00 am

Checking in here, I see that I have been trying to transfer my cell phone number to a new smart phone for OVER 6 weeks now! I started by ordering an iPhone SE from Tracfone, my original provider, on 9/4. By 9/23, after having received an iphone with the SIM card not installed and not being able to get any help from Tracfone (I found their online instructions incomprehensible), I returned the iPhone to Tracfone and ordered the same phone from Consumer Cellular for $50 more than Tracfone charged--but oh well, at least you can talk to people at Consumer Cellular.

But since 9/23 I have been trying to get my phone number ported over from Tracfone to Consumer Cellular and it STILL isn't done. And while Consumer Cellular answered right away before I had signed up with them, I now find myself waiting on hold for 25-45 minutes every time I call. I don't always have time to do that, so it can be a week between calls if I am too busy or tired.

Consumer Cellular claims that this is Tracfone making things difficult. I finally DID get Tracfone to get someone to give me a call and he said that the number would be ported over, but that was about 3 phone calls ago

At least Consumer Cellular gave me a number direct to their "porting department" rather than making me go through the general customer service for my next call, which I hope to make tomorrow. Too tired/busy to tackle it today.

Can I just put it out there?: I HATE CELL PHONES!!! They are a device of the Devil himself as far as I am concerned! G-D- electronic leashes. UGH! the only thing I like about them is having a phone in hand when I am driving, and I will like having a GPS once the iPhone is hooked up. My old cell phone is a dumb phone so I haven't had that.

First world problem though. Frustrating nonetheless. Since this so far (knock on wood!!) is my biggest problem of the year (other than poor kitty Bridget passing away in April), I am overall quite blessed.

Posted in

Uncategorized

|

2 Comments »

September 24th, 2021 at 01:57 am

Well, Tracfone has proven to be a miserable experience with getting the new smartphone set up. They sent a phone without a SIM card installed and I could not understand the instructions for inserting it....they had a web page with pictures but my brain does not process that kind of information well and there was no way to actually speak to a person to ask a couple of questions.....so I gave up and called Consumer Cellular and ordered an iPhone from them instead. They will ship it with the SIM card installed and best of all, you can TALK to a real person (based in the US) when you have a question. I am having to spend a lot of time online with Tracfone anyways to transfer the service over, but I will be glad to be done with them. A decade ago when I started with them, you talked to a person when you had questions, but no longer. The only way to actually talk to a human being is to book a service call. I do have one of those set up for 11:30 am tomorrow.

The Consumer Cellular phone should arrive by Monday at the latest and then it will take a couple of days to ensure that my phone number is ported over and then I will be able to cancel with Tracfone for good. I'll lose at least a hundred dollars all told in pre-paid service that I won't be using plus the same phone purchased from Consumer Cellular costs $50 more, but it's worth it to me to call up and speak to a human being.

Posted in

Uncategorized

|

1 Comments »

September 4th, 2021 at 02:33 pm

I purchased an iPhone SE, 64 GB. I paid $4.95 for shipping (rather than the free 2-day option) so hopefully it arrives tomorrow and I can get it activated and play around with it over the long weekend. I decided to stay with Tracfone for now with the prepaid plan since that gives me flexibility. I started off with a $25 for 30 day plan, which includes 2GB of data, but I can move to a $15/month ($14.25 with autorefill) plan if i am not using much data.

I also realized that having the smartphone will allow me to use my fitness app, OpenFit, for outdoor walks as well. I've been using OpenFit since mid-July and their interactive "Easy Step" walking program has been a real motivator, keeping me much more consistent with my daily step count (except when work gets overly busy, as it did last week). I've been walking indoors in the A/C so far, but now that the weather is beginning to cool, I look forward to resuming outdoor walks along with their program. So there's another benefit besides GPS that I will get from having cell phone service rather than sticking only to WiFi access.

I also stayed with Tracfone because they will give me credit for my existing service, which is good until February of 2023, and the unused data can roll over month to month. That savings alone would save me compared to the 5% AARP discount I would get if I switched to Consumer Cellular. Also my primary network will be Verizon, so that's good. They also have contracts with ATT & T-Mobile so I should be covered whereever.

Coming into the 21st century at long last!

Posted in

Uncategorized

|

1 Comments »

September 3rd, 2021 at 02:08 am

I've been using a basically "dumb" cell phone on a prepaid plan with Tracfone for over a decade. In the past few years, I've coupled the dumb-phone with an iPod Touch, which has allowed me to access various apps as long as I am connected to WiFi.

I have been thinking of a while now of upgrading to a "real" cell phone and a monthly service plan, rather than the prepaid phone that I have now. I got a kick in the pants about doing this today when Tracfone messaged me that my phone is no longer supported on their networks and that I can expect to start seeing my calls dropped or unable to go through progressively more often.

I need the phone for my job (especially once we are out and about more; we still have 2/3s of our client meetings over Zoom), but I've never researched cell phone plans. Since I'm used to the iPod Touch, I'm planning to go with an iPhone, but I'd be curious to hear about what cell service plans people have and like and especially *why* you like --or dislike-- your plan.

It's just me, so I won't get any benefit from any family plan.

Any thoughts you care to share are appreciated!

Posted in

Uncategorized

|

4 Comments »

August 29th, 2021 at 01:53 am

My birthday was this past week. It was a pleasant enough day. Everyone at my office knew and wished me a happy birthday when I arrived at work. I have a couple of friends who have promised to take me out for a meal, but since my birthday fell mid-week, I didn't have any plans for the day itself. Rather than being upset at being alone on my birthday, I decided to treat myself to a dinner at a nice restaurant in town that I've always wanted to try, but one that is more upscale than I would pick for a meal that a friend was treating me to. The dinner was very nice; I was seated at a window overlooking our local extremely quaint historic district. (The restaurant was the 1741 Terrace, so that gives you an idea of how old our local history is!) I used the opportunity to do some reflection over my life to date. Since I just completed the CFP(r) and have spent a good chunk of the last 20 years focused on changing careers, it was a good opportunity to reflect over what I will want out of the *next* 20 years.

And I still have two meals with friends to look forward to during the next month. (Hopefully by then, the current wave of COVID cases will have peaked and be on the downswing again....I did read that if our pattern in the US follows what happened in the UK, Labor Day should be the peak of the current outbreak).

Posted in

Uncategorized

|

6 Comments »

August 6th, 2021 at 10:41 pm

I took the day off work today and headed north into the Poconos about 90 minutes to meet up with fellow SA blogger Patient Saver. This is about the fifth or so F2F get-together we have had. We both started on SA around the same time in 2006, and met in person for the first time a decade ago when I was driving to New England for a cousin's wedding and realized that I would be driving by where PS lived. That first visit was a meet-up and walk as a break on my drive back to PA from New England, but since then I have visited and stayed over at PS's house, and once we booked rooms at the same B&B in the Poconos. In recent years as we both have older kitties with health problems, we opted to meet for day at a town near where PA, NJ, and NY converge.

The last time we did this was in 2019, and we took a hike to a nearby water fall, did a walking tour downtown and had lunch at a restaurant in town that had been originally opened by a chef from Delmonico's in NYC. This time, with PS having an injured knee, we rented bicycles and headed out to the trail that runs along the Delaware River. I will confess that I was VERY nervous about this, as I had not been on a bike in over a decade, and I'm even more out of shape than usual since I've spent so much time in recent months hunkered down studying for the CFP exam. We didn't get tremendously far (certainly not the 7 or so miles the guy at the bike store estimated we would be able to do before hitting a construction point where the trail is currently blocked), but we did a few miles and I survived and even re-mastered shifting on the bike (which was a 7-speed; my own bike is a 21-speed). I know that PS was up to go further, and I am grateful that she was gracious about my limitations. Maybe after getting back on my own bike and getting much more in shape than I am currently, I'll be able to manage the longer ride.

I'm ridiculously proud of myself for having done this even at the same time as I am embarrassed at my abysmal performance. If you don't push yourself outside your comfort zone, it will just continue to shrink. I know my comfort zone shrank during the pandemic when I spent over a year not driving further than 12 miles from home. So even a 90 minute drive is still more of a challenge than it used to be, when I wouldn't think twice about it. This time, I took my car to the shop and had my annual safety inspection done beforehand "just in case."

After the bike ride, we ate lunch at a nearby seafood restaurant, blissfully uncrowded and blissfully air-conditioned. We both treated ourselves to dessert after our exertions. Then we went and explored some antique stores, which reminded me a lot of my grandparents, both because many of the contents were from the era of the contents in my grandparents' home and because my grandfather owned a stall in an indoor antique-mart for about a decade as a retirement career, and I thus spent a lot of time roaming around antique stores as a child.

It was good to catch up with PS in person and I'm glad that she pushed me outside my comfort zone even if I whined and complained a lot!

Posted in

Fitness

|

5 Comments »

August 2nd, 2021 at 06:52 pm

I paid my mortgage down to an even $42,000 this morning (it was just about an extra hundred dollars beyond the usual payment to get down to this amount). That is an amount that feels do-able before retirement (I will turn 61 this month and plan to work at least until my full retirement age per SS of 67). I now own approximately 3/4s of my home's value.

The rate on my original 30-year mortgage, taken out in 2005, was 5.875%. I refinanced in 2012 to 4% and a 20-year mortgage. I've been paying extra on the mortgage monthly for years. While officially there's 8.3 years remaining on my current mortgage, I'm aiming to pay it off by the end of 2027 at the latest.

My bank sent me a notice offering me a 2.5% rate on a 10-year mortgage. I think I'm going to take it. The monthly payment will decrease by about a hundred, which either I can use to pay down principal or which I can use to pay down some of the non-mortgage debt, which never really seems to go down.

As a home owner now almost 16 years into home ownership, I've hit the point at which repairs, maintenance, and replacements are beginning to take their toll. So far this year, I've replaced the washing machine, A/C, and hot water tank, and had a couple of costly plumbing repairs. Yesterday the neighbor approached me about redoing the concrete stairs. My house is a twin, so it really makes sense to redo my stairs at the same time she does hers. A neighbor has been patching them yearly for the past several years, but they really do need to be replaced. They also will probably no longer squeak by city code--they're too steep and we will have to add an additional step to meet code. But that will have to be done in any case--and it will be nice to no longer worry whether my older friends can make it up my steps! There have been times when I have had to let older friends in through the bathroom that has a door out to the back porch, since there are fewer and less steep stairs if you go in that way. That job will not be cheap, but it's also something that should be done.

I had actually approached the former owner of the twin next door about replacing those stairs a couple of years ago, but he wasn't interested in doing it. I'm glad the current owner is. When you live in a twin, cooperation and good neighbor relations are important!

Posted in

Goals

|

4 Comments »

July 24th, 2021 at 04:10 pm

I have a friend who has traveled to visit me virtually every year since I moved back to Pennsylvania from Vermont in 1999 (with two exceptions: last year due to COVID and 10 years ago, the year my mother died). We met because we taught at the same small (now-defunct) college in Vermont, she as an English professor with a special interest in the medevial period and me as a Psychology professor, and both of us owners of Basset Hounds. A local college sponsors an annual Shakespeare Festival with a mix of equity actors and students, and each year we have gone to a production at the festival as well as had time to catch up with each other and what has been going on in our lives.

So this week was my friend's annual visit, from Thursday afternoon to Saturday morning. Her visit prompted me to actually do greater cleaning and decluttering of several areas of my house than I have done since her last visit in 2019. I can actually see my dining room table top for the first time since March of 2020! Once we entered the COVID shut-down in mid-March 2020, my dining room table became my work station as well as my CFP exam study area, with extra piles for mail that needed to be dealt with.

The decluttering was only superficial--there are ten banker's boxes in the living room with papers cleared from the dining room and other assorted surfaces. Some of it will be kept, much of it will be recycled; at least it is now coralled to be dealt with gradually.

Thursday after she arrived, we spent an hour on the porch chatting over glasses of iced tea. The performance at the Shakespeare festival ("A Midsummer Night's Dream") was outdoors. It started at 6:30 and ended just as dusk was starting. One of the chores I had not had time for before my friend's arrival was grocery shopping, so we ate out beforehand at a Greek restaurant that we have previously eaten at. That restaurant had had a fire in June of 2017 and had been closed since then, finally reopening last December. We had missed being able to eat there in 2018 and 2019, so it was nice to get back to our usual pre-theatre restaurant.

Friday morning I was able to run out to the grocery store before my friend woke up. I had pulled together a list of local activities we could do and my friend chose to go to the arts trail in the next town over. We walked the trail, stopped for an ice cream at the small upscale mall/condo area where we had parked, then drove over to the local indoor Farmer's Market and browsed around there. We got home around 1:45 pm, had some sandwiches for lunch, then headed back out to explore the shops on Main Street in my town. By the time we got home, the Achilles tendon I injured a couple of months ago was throbbing, so we took an hour for me to ice my tendon while my friend worked some puzzles on her iPhone. Then I pulled out the sous-vide machine I bought myself last month and my trusty Instant Pot and made dinner (zucchini-fennel soup, salmon, potatoes, green beans and mushrooms, with chocolate truffles from a store at the Farmer's Market for dessert, as well as Sauvignon Blanc with dinner).

This morning, we went out to breakfast at a local cafe before my friend got on the road to drive back to upstate New York.

It was great to catch up and have some real time to spend with someone.

***************************************************************************************

In general, I still am very much "unwinding" and refocusing my perspective after having been laser-focused on the CFP exam since last October. Today, I may go back to an old favorite coffee shop along the Delaware River, which I have not visited since pre-pandemic. They have tables outdoors along the canal towpath, which provide a nice place to sit and write. That is, I'll go there if I can summon the nerve. I have driven so little since March of 2020 that this undertaking is a real endeavor. (Actually, when I took the CFP exam, I had to take it in King of Prussia, outside of Philly, and I was actually more nervous about doing the 55-mile drive down and back than I was about the exam.) Other than my trip to take the CFP exam, I haven't been more than 12 miles from home since sometime in 2019.