|

|

|

January 10th, 2026 at 05:27 pm

I'm very excited about this. I had heard rumors a few months ago about a gym being constructed on the fifth (top) floor of the building where I work, but I had heard it in the context of another firm's paying for their employees to have access.

Then this week, we received notice that the gym is open to anyone who works in the building, in exchange, for now, for a $100 access payment. They note that they may apply monthly charges eventually, but for now, it's a one-time payment. They had an open house yesterday and I signed up on the spot.

In addition to the weight and cardio machines shown, there is a small yoga room as well as changing rooms with a shower. The gym opens early next week. They have to modify the permissions on our key fobs that we use to access the building first. Then it will be available 24/7.

I am hopeful that this will FINALLY allow me to start making progress on my goal of adding strength/resistance training into my workouts. I do have a Planet Fitness membership, but that is 6 minutes away in the other direction from work, and, even though 6 minutes (x 2 for there and back = 12) is not much time, I rarely make the time to get over there. But I spend a LOT of time at the office, including about half of my evenings during the week and most of my weekend time during the days.

This a key reason why my house has gotten cluttered--I avoid it because there is no kitty there, and then I avoid getting another cat because there are piles of things that would be unsafe for a cat to jump on...the more I avoid the house, the worse the clutter gets, the more I avoid the house, and so on. I'm hoping to break that cycle this year. The gym won't help with that, as it's even more reason to be away from the house, but it should make the strength training goal possible, at least, and allow me to be more efficient with my days. Having a gym onsite means that I will feel freer to go upstairs in the late afternoon, when I often get sleepy but force myself to power through, and do a short workout up there, since I won't have to add travel time on to the workout time. And perhaps taking a break when I am sleepy to do 10 minutes of rowing or some kettlebell swings will help me feel more energized so that I need to spend less time at work.

This is at least one good thing to the start of 2026.

Posted in

Goals

|

5 Comments »

January 6th, 2026 at 02:14 pm

I had a couple of outstanding non-mortgage loans (mostly arising from my beautiful Buffy cat's illnesses). I paid them off this morning, so now the only debt is my mortgage (down to $19,500 so the end is in sight) and credit cards, which are a rolling balance. I typically use the first paycheck of the month to pay down loans and the second to pay down credit cards, so the CC balance is around $3k right now and that will come down when the next paycheck arrives on 1/16.

Banks use a "debt-to-income" ratio to evaluate people for loans and this cut mine significantly.

I also changed my retirement contributions from 18.5% to my 401(k) down to 6% (which will get me the full company match of 5%). That's because I need to build up a year's worth of savings in a taxable brokerage account, which I will be able to tap into without a tax consequence after retirement. The ~$400 per month I was paying towards those two loans will also be redirected to brokerage savings.

I also did some calculations and I am on track to be able to retire in 3 years. (Possibly less, possibly more; this is an approximate target.)

Also started tracking spending and have started going through my subscriptions and canceling ones I don't use.

Posted in

Goals

|

3 Comments »

January 1st, 2026 at 01:56 am

Because of the New Year holiday, my paycheck came a day early, enabling me to make a few credit card payments.

As of today, my total debt is $29,889.40. Total assets are approximately $1.2 million (some accounts won't show the 12/31 balance until tomorrow morning), so Net Worth is $1.17, a 15% increase from last year.

Tomorrow I will calculate my RMD from my beneficiary IRA and take a distribution to pay off my outstanding consumer debt. The mortgage payment will hit the account as well. Once the two outstanding consumer loans are paid off, total debt will be around $20k plus revolving credit card balances which I will pay off monthly. So I'm feeling good about my "Wealth" goals from last year.

In terms of "Health" goals, my weight is basically the same as it was last January, and I've surpased 1,000 walking/running miles (1,089 to be exact), a bit more than last year but less than 2022 and 2023. I need to finish tabulating my runs for the year but it was generally 8-12 per month except for slacking over the summer due to the heat.

In terms of my "Systems, Habits, and Routines" goals, that was not a priority and the house is a mess; I will spend a good chunk of New Years Day clearing off the dining room table, which is back to being stacked about a foot high except for the one space that I keep clear for eating and working. But I *did* do a better-than-usual job of making sure that I have gathered the tax letter information that I need to send out to my clients and their tax preparers during the first couple of months next year. They used to have someone on our client service team compile much of the data; then when our company was acquired, that person was overwhelmed trying to manage software changes and didn't compile it for us, which meant the task fell out us without warning. That made the beginning of last year stressful. This year, anticipating that the data won't be compiled for us, I spent Christmas Day going through client files and making notes, so I am feeling on top of the task for this year. [It was a good way to pass the day.]

As far as 2026 goals, I am going to try and make the "Systems, Habits, and Routines" category my main focus for the year, after having focused on debt reduction for 2024 and 2025. Specifically, I am going to start tracking my spending again, and I am going to spend a little bit of time doing some decluttering daily plus I am going to HIRE somebody in May or June to help me make progress and make sure that I actually get stuff out of the house, not merely shuffled around. If I am successful on that front, I will probably look to adopt two new cats, although I might wait another few months and try to do some traveling first. For 2026, I am looking at weekend trips to Phoenix to visit my cousin maybe in April and a trip to visit a friend in Atlanta in May, then a driving trip to visit another cousin in MA over the summer.

I also want to keep up the exercise goal and will probably make another stab at working with a personal trainer, since I don't keep up well with strength training when left to my own devices. Hoping to walk/run at least 1,200 miles (if not 1,400 miles, my 2022 amount) next year.

So tracking spending and decluttering are the two big focuses for next year, all in service of clearing the runway to be able to retire in the not-too-distant future.

[And on that front, I went ahead and filed for Medicare Part A, since I am now eligible. I still have my work health insurance, which will remain primary until I retire and start Part B, but Part A will be there as a secondary payer if anything drastic occurs, and, most importantly, it will get me a Medicare number, which is the lengthy part of the filing process, so that when I DO retire and start Part B, D and a Supplement, that process will go more quickly.

Happy New Year to All!!!!

Posted in

Goals

|

2 Comments »

December 5th, 2025 at 03:34 am

I paid a little bit extra on my mortgage today to get the year-end balance to a round $20,000.

Total debt as of today is $30,242, just $242 from my end-of-year goal.

It's a nice booster for a very busy week. The custodians (Fidelity, Schwab etc) have deadlines for submitting requests for things like Qualified Charitable Distributions, Roth conversions, or Required Minimum Distributions. As the managers, we can handle transactions in client accounts when they are all in cash, but sometimes when the transaction involves stock, the custodian needs to be involved. I don't deal with that part of the business so I don't know the details, only that there are deadlines. So I have been busily working my way through my lists to make sure that all RMDs are going out, that we have followed up with clients on every Roth conversion we suggested, and so on. It's been a busy few days. I didn't work on Thanksgiving but I worked through last Friday, Saturday, and Sunday, and this is the first evening this week that I left the office somewhat early (at 7 pm). Two more weeks of client meetings and then I am taking off from December 19th through January 1, a full two weeks. I haven't done two full weeks in the entire time I've worked at my current company, and I've now been there over 9 years. But taking more time off is one of my New Years resolutions, which I am implementing early.

Posted in

Uncategorized

|

6 Comments »

November 24th, 2025 at 12:13 am

Go to the Forums section, click on the Login link in the upper right, click Forgot Password and they will email a link to set a new password. Seems functionality on the blogs is weird as new posts aren't showing up once you click into them.

Posted in

Uncategorized

|

3 Comments »

November 16th, 2025 at 08:44 pm

The goal that I have focused on the most this year has been debt reduction. I started the year with about 50k in total debt and should have the debt down to 20k, mortgage debt only, by a week into January 2026. That is a huge weight off in terms of preparing for retirement or cutting down at work (more likely moving to 75-80% time for a while, then full retirement--although it is fairly likely that, even after I "retire," I will either work tax season for a few years (make some extra money during a time of year I'm not likely to be out and about much in any case--not a big traveler and will travel even less once I get new kitties), or else I'll stay with my firm in a consultant role and continue working with some key clients for a few more years, as long as I can coordinate it with my supervisors so that there are some months where I work more and others where I do not have any client obligations at all. That's all TBD--having invested so much of my life in my professional identity, it's hard to imagine NOT having one.

With the mortage down to $20k, I'll accelerate payments slightly. My current payment excluding escrowed insurance and taxes is $498.26 a month, with $430 a month is going to principal (I always round off the payment to reduce by an even number). I'll accelerate that by $70 a month in 2026 and pay off $500 of principal a month, which will make the balance $14,000 in January 2027, and $8,000 in January 2028, at which point I will use my RMD to pay off the balance. [I probably won't be entirely debt-free at that point, since I'll probably replace my 25-year old furnace in the next year or so as well as doing some other home upgrades, taking advantage of the HELOC I recently opened to spread the payments out over time. Also, once the house is paid off, I will replace my 2012 car in 2028.]

I also took a look at my accounts and decided that I really need to have more funds that are readily available without major tax consequences. I've been using my beneficiary IRA and Roth IRAs (as well as 0% balance transfer offers on credit cards) to manage large unexpected expenses for a while now. And of course there's a tax hit for every beneficiary IRA draw. So I've decided that next year, I'm going to contribute just 3% to my 401k in order to ensure the company match and then save the rest (currently another 15.5% of my salary) to a brokerage account to build up a liquid reserve, most of which will be kept in short-term Treasuries. The goal is to build up at least a year's worth of spending needs in that account before I retire.

Finally, I've already decided that it's time to start tracking my expenses again--something I used to do religiously when I first started on this site in 2006, but which I stopped doing after 2015 after I made the change (in October 2014) from working as a part-time and/or temp tax accountant to working as a full-time financial planner. Mastering the new career responsibilities didn't leave me the mental energy for tracking, plus I had a larger and more reliable source of income, so I stopped. I just took the old spreadsheet I used to use (the Excel Budget planner from simpleplanning.net) and created a blank copy to start using in 2026.

Part of that is reviewing online subscriptions I have. I've been somewhat loose with those, maintaining some that I don't often use "just in case." I'm giving myself until the end of the year to "use them or lose them" and will turn some of those off in 2026. (Except for the gym--the Planet Fitness $10/month plus $49 once a year price is so relatively low that I'll maintain my membership even if I only go a few times a year, at least for the moment. The next annual fee is 8/1, so I'll make a firm decision about that membership before then....I do need to do SOMETHING about strength training, which I don't seem to manage well at home.)

Also on tap for later today are taking a look at my benefits--it's Open Enrollment. I stopped the HSA earlier this year in anticipation of turning 65 (there is a 6-month lookback on HSA contributions when you claim any part of Medicare; now that six months has passed, I need to sign up for Part A) but I started contributing to an FSA instead. That's the part I need to think about. It's frustrating because you can use an HSA to fund long-term care insurance premiums, but you can't use an FSA to pay those. When I had the HSA, I used all or a good chunk of it to pay my annual premium each year, and I saved much of the rest. I still have enough left in the account to pay half of my LTCI premium for the next two years, but after that, the premium will be fully out of pocket.

It's also self-review time for work, which means setting annual goals. Last year we had just done the first of two corporate acquisitions so we really didn't do a full annual review. The new company is a big corporation (11,000 employees in over 700 offices, compared to the original small family company of 24 employees in two offices), so I have to review what their process is like. I've been procrastinating on that. We'll also learn what makes one eligible for a bonus under the new corporate umbrella. The old family company gave every employee a bonus (the same % of salary) if the company met its profit margin for the year. The worry has been that the new company may reserve bonuses for "business development," which is more something that lead advisors do and which those of us in subordinate roles have had less obligation to do. Those bonuses (as well as the RMDs) have been how I've paid off my debt, so losing those would be a blow--as well as a significant pay cut--bonuses under the old system varied from 5% to 20% with only one year that I've been here where there was no bonus.)

My friend Elizabeth is about to send over a Thanksgiving invitation. I've gone to her house for several years, probably since 2017 or so. Last year I skipped it and I will probably do the same again this year. Other than our mutual friend Sharon, it's Elizabeth's family and friends, who I don't see other than Thanksgiving, Hanukkah, and Passover. They're nice enough, but there's no one other than Elizabeth and Sharon whom I'm close to. She moved the Thanksgiving get-together to her son's house a couple of years ago, which is further away, and with my new company, I only get Thursday off and not Friday, so I think I'll take the day for myself (plus the obligatory call with my sister). Sharon, Elizabeth, and I are having lunch the following week so I'll still get to see the people I really want to catch up with.

It's hard to believe the holidays are here. The building Christmas decorations went up yesterday morning and the city (Bethlehem the Christmas City) decorated during the month of October, although they haven't been turning on all the lights at night yet. Yesterday was the first of four holiday Cocktail Trails sponsored by the Chamber of Commerce and all over downtown people were wearing Santa Clause hats or outfits in red and green, so the holidays are definitely here. At least the building hasn't turned on the Christmas Muzak yet!

Posted in

Uncategorized

|

3 Comments »

October 19th, 2025 at 08:32 pm

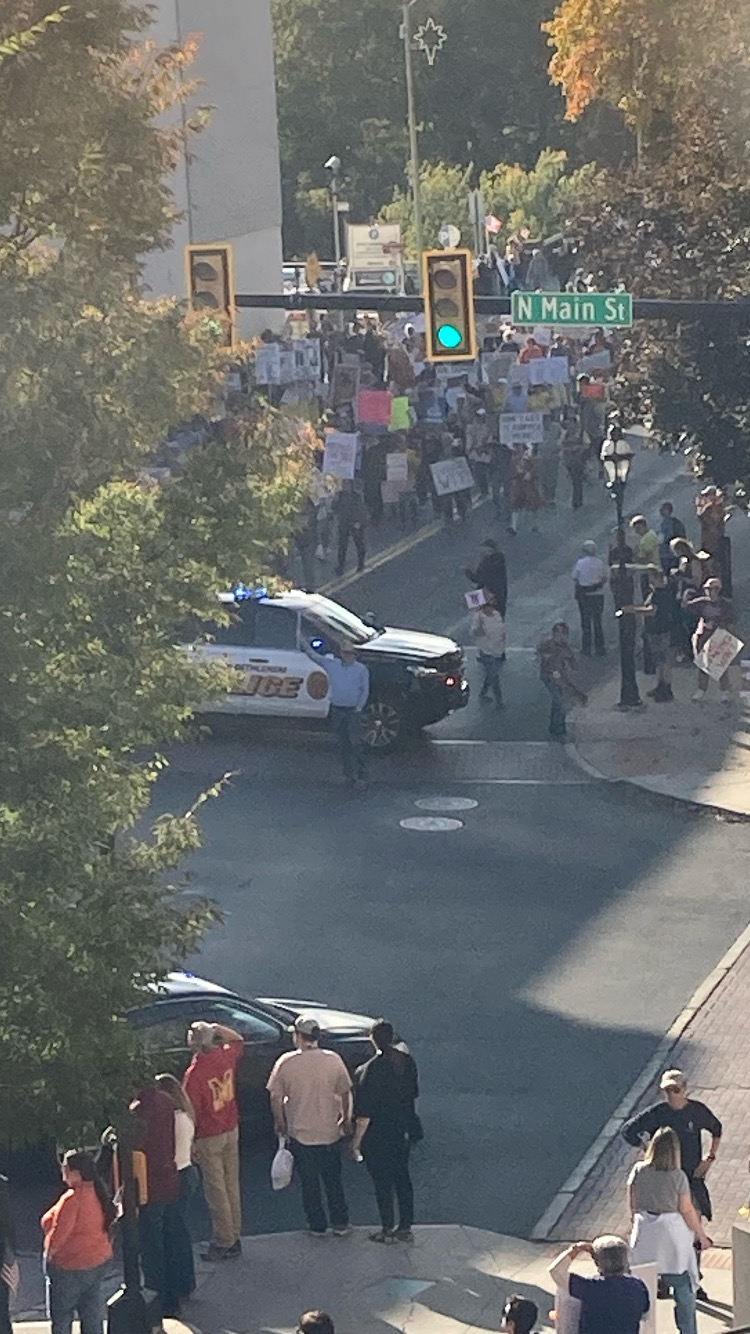

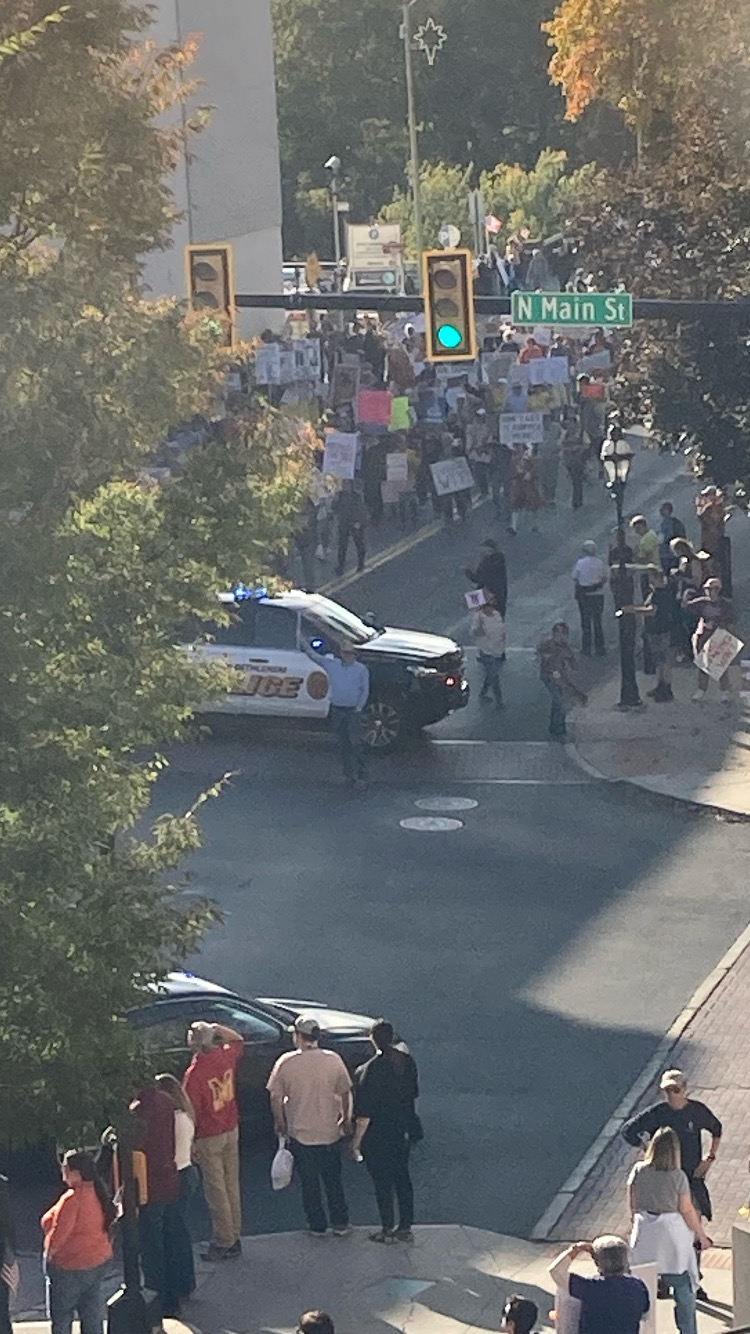

Can't really tell from this, but this rally was bigger than the June one (which had a turnout of about 5,000). Last time, the rally stopped at this intersection (the biggest intersection downtown, where my office is located); this time, they continued on to march another half mile to City Hall.

Posted in

Uncategorized

|

9 Comments »

October 19th, 2025 at 07:57 pm

I can see the photos so hopefully you can too. These were the photos that were supposed to go with a prior blog post--my big home improvement for the year. I'm thte unit on the right. I chose the all-aluminum stair railing and my neighbor went with PVC, which was cheaper. Definitely an improvement! The old stairs were not only falling apart, but were inappropriately sized. There's an extra step added. I have no idea how the old stairs made it past home inspections, but they did. There was one spot on the old stairs where the rise was 11" high! (Legal limit for most jurisdictions is 8"--these are 7.5".)

If I've got this figured out, maybe I can do a photo-a-week--I know I won't manage a photo-a-day.

Posted in

Uncategorized

|

5 Comments »

September 14th, 2025 at 08:52 pm

I haven't seen your August report yet. You have been one of our most consistent bloggers, so I am hoping you are ok. I know you are in the Chicago area, so I have been thinking of you as 47 makes his threats against the city. I hope you are well!!

Posted in

Uncategorized

|

2 Comments »

September 13th, 2025 at 09:39 pm

Last weekend, I drafted my HELOC application. I had a few questions, so I brought it with me to a bank branch to ask those yesterday, and ended up submitting the application.

I'm on target to have all current non-housing debt paid off in January. That's when I typically take my Required Minimum Distribution from my inherited IRAs for the year and use them to pay down debt. My RMD for next year will be about the amount of the remaining non-mortgage debt as of January--and by January, the mortgage will be down to 20k!

I even managed to do the stair project without taking on any new debt. It cost about $4k total for my half of the stairs plus the new railing. I wish I could figure out how to post pictures to show the before and after. and and  . The photos are in my google drive but they don't show up here when I try to link them. . The photos are in my google drive but they don't show up here when I try to link them.

Looking at my goals set earlier, I see that I'm again ahead of things on the debt paydown--January 2026 should be 20k total since I don't anticipate taking on any other debt before then. (The HELOC is just making a line of credit available, not yet drawing on it.). That will cross one of my four pre-retirement goals off.

********************

I went on another bed and breakfast trip a few weeks ago for my birthday. I went to the same place, and, while it was good, it wasn't as good as the last trip. The weather was hotter and that meant that outdoor activities were more uncomfortable so I did fewer. And I didn't get as much time to sit/think/read as I wanted. Oh well. My take on birthdays has become, "I survived (without getting seriously depressed)." I at least met that goal for the year.

******************

The past two years, I've been really focused on paying down debt. Since I expect to have that issue under control, my goal for next year is to focus more next year on tracking my spending, which is something I used to do (back in my early days on this blog), but is something I haven't done at all in the past decade, once I had successfully made my career change and landed in a position that paid me more than previously.

I don't spend frivolously, but there are some categories where I don't make a serious decision any more--if I want to buy a book, I usually buy it, or if I want to go out to eat, I do (although I generally go to diners or small ethnic restaurants where my meal cost is under $20 or at the high end $30). And education--I still spend lots on professional education. I get reimbursed for some, but I typically take more than I need to satisfy my continuing professional education requirements, and I won't get reimbursed for taking more than needed, so I spend out of pocket for that. Then this year, I traveled a bit too. And most years (but not the past two) I have pet care expenses.

Anyways, I realize that, as I now have eventual retirement in my sights as a "North Star" goal, I need to become more conscious of my spending habits once again, as well as planning more for what I will do once retired. Current book on the reading list is "You Only Die Once." I have some general ideas about what I want to do, but no specific plans yet. I do hope to see if I can manage to trim my hours at work in another year or two, so that I have time to start making connections and getting involved with activities as a segue into the next chapter.

Posted in

Uncategorized

|

8 Comments »

July 19th, 2025 at 11:43 pm

I reached a milestone this week--total current debt under $35,000! That's $22,300 on the mortgage (which I estimate I can pay off at the end of 2028) and the rest on loans at rates ranging from 4.99% to 7.98%). The first of those loans will be paid off in a month. That's about $360 a month of cash flow freed up, most of which I intend to put in my brokerage account so that I start building up a decent balance in a taxable account. Then another loan I will pay off a little early in January 2026, freeing up another hundred. Then the third loan I will pay off, again a little early in January 2027 (I have inherited accounts subject to Required Minimum Distributions, so I typically take a chunk (or all) of my RMD early in the year to pay down debt), freeing up $300 in cash flow (so that's now a total of $750 a month that I should be able to contribute to the taxable account by then). I'll throw an extra $2k at the mortgage in January of 2028 and that will enable me to pay it off before year end. So that will be all of the current debt gone! (Other than credit cards, which I pay off monthly.)

I'm not saying that I will be able to retire debt-free. I expect to replace my now-13-year-old car in 2028 or 2029 so that I go into retirement with a new(ish) car. I project that would be the last car I ever buy, since I expect to be in the "slow-go" phase of retirement and living in a "lifeplan community" in my early 80s by the time a 2028 acquisition runs its life course. Those communities provide transportation to doctor's appointments, the grocery store, out to entertainment events, so I expect I wouldn't really feel the need for a car by then since I would be able to satisfy my other transport needs that are not met by Uber or its like.

Plus I do expect to do some improvements to my house in the years before selling it. Nothing MAJOR, but my furnace is 25 years old, the house really needs to be painted (it hasn't been since I bought it 20 years ago), and I'll make improvements to both the kitchen and bath (which both date to the 70s or earlier) and finish replacing the appliances that have not yet been replaced (oven and dryer, and I'll probably need another water heater by then too). One of my to-dos for the next month is to go open a new HELOC because my existing HELOC (at a $0 balance for the past 6 months or so) will stop allowing me to make new draws as of November, so just as I go into retirement and have the time to deal with deferred maintenance, I won't be able to borrow to do so. A local bank has a HELOC that does not have an end to the draw date, so I'm planning to apply for a new HELOC there and close the old one out.

So chances are that, by whenever I pull the plug on retirement, there will still be some debt, but it will probably be just a 3-4 year car loan and the HELOC, which would be repaid when I sell the house in 2032 or so.

Posted in

Uncategorized

|

5 Comments »

June 23rd, 2025 at 12:36 am

It's been a month since I last posted, so a quick update:

At the beginning of the month, I went on the retreat that I had previously scheduled in the Texas Hill Country. I was pretty scared about going the week before, but kept on telling myself that I would be glad that I went once it was over.

Not only am I glad that I went, but I actually enjoyed the trip and made some new friends. This was a retreat organized by a woman who runs several a year (except for this year, when she is onlyI running two as a result of an injury she suffered last year that led her to cancel most of her events), and there are Zoom calls for members of this group a couple of times a month, so I can maintain contact with those from the group who show up to the same events that I do.

While I did push myself out of my comfort zone, I did manage to stay out of the panic zone, especially thanks to one woman who hung back with me as I was the slowest hiker in the group. I am very grateful to her--and more motivated to work on building up my leg strength for hiking up hills so that I can become a stronger and faster hiker.

Work has been busy since returning, but I've scheduled a 10-day "staycation" starting next Friday, when I hope to make some progress on decluttering.

My neighbor took care of getting estimates for replacing the front stairs and that project will come in less expensive than previously anticipated. I'll still open a new HELOC since the "draw period" on my current HELOC expires in November, just as I get closer to retirement and can see actually having the time to pursue more projects. But I'm already quite close to my stated debt goal for the end of the year of $35k total--the current total is about $37.2k (of which ~23k is the mortgage), so I should meet/exceed my EOY goal easily--knock on wood and praying there aren't other big unexpected expenses that pop up between now and then.

That's a good thing, since I recently learned that the company I work for is being acquired AGAIN. We went through an acquisition last August, which moved us from being a 22-person, 2 office family-owned company to being part of a 110-person (at the time), 10 office firm, and the integration process has been an additional source of stress. Now we're being acquired by a firm that has 11,000 employees and something like 700 branches. They say that there should be less disruption from this acquisition than from the last, since we will be siloed from the rest of the firm as we have a different business model (RIA as opposed to B/D, if you know what those are), but, we'll see. In any case, the closer I get to "financial independence" and feeling like I COULD step away if I wanted, the better. Still targeting retirement for 2029, but, we'll see how things work out. Just being able to feel like I COULD step away would be tremendously psychologically freeing.

Posted in

Uncategorized

|

3 Comments »

May 23rd, 2025 at 02:13 am

Temporarily, at least. I paid off my last 0% balance transfer card this week. Now what I have left is my mortgage (around 23k at 4%), about 10k of loans that will be maturing over the next 20 months, and about 3.6k of revolving credit card debt that will paid off by my next two paychecks plus some expense reimbursement from my company.

So the debt is under 40k, finally, after a long period where it hung out at around 80k. But I've made a concerted effort to pay it down the past 3 years.

Unfortunately, it won't stay down quite that low for long as I have some home projects that MUST be done. I'll be taking out a fixed rate home equity loan and a HELOC to cover those, but I'll be using them JUST for capital improvements, so at least they should be expenses that I will partially recoup when I eventually sell my house. The front stairs are crumbling and need to be replaced, so that will be done this year. I've been wavering on whether I should replace my furnace now because it's 25 years old, or wait, and also thinking about replacing the dryer and range before the tariffs hit--but I probably won't. The front stairs are a definite project for this year, though, and I'm expecting it will end up costing about $8,000 based on the research I did last year.

I'm not rushing out to buy a car to beat the tariffs, as I drive less than 5,000 miles a year. I currently drive a 2012 Subaru Impreza without any bells or whistles. We'll see how long I can make it last (it has less than 68,000 miles on it). It goes into the shop tomorrow for a repair; hopefully that won't cost too much, but it should be my one big car expense for the year, knock on wood.

Posted in

Uncategorized

|

6 Comments »

April 13th, 2025 at 11:15 pm

Net Worth down about $7,500 from end of 2024.

But in good news, debts are down about $8,000, from around $50k all-in to ~$42k all in. Q1 is always when I make the biggest progress on debt, since that is when I receive my annual bonus (if one is forthcoming).

I have two trips coming up in Q2 (both planned before the current market mayhem): Patient Saver will be coming for a visit again and we will go to Gettysburg for a day, and then I'll be going on a hiking and kayaking trip to Texas Hill Country with a group of other women in their 50s and 60s. This is something that is pretty far out of my comfort zone, but hopefully not into my panic zone. I want to see how well I can keep up and hopefully I will enjoy myself. I do know about 3 of the participants at least a little from an online group.

So in my off-work hours, I have been focusing on training for that. I've been running pretty regularly, short distances, but I've done a 5k distance 8 times so far this year, and will build that up in the next several weeks leading up to the trip. I also need to get outside more (mostly I run indoors) and practice hills, which around here are plentiful. Until now, I've started adding a weighted vest. I've also been doing some strength training online with a personal trainer, focusing on learning how to better use exercise equipment I have around the house (a TRX-like setup, dumbbells, kettlebells). I need to get more consistent about that.

Tax season is just about over, thank god. It's been really hard on me this year. I've been more exhausted than usual and am so looking forward to getting to the time of year when I have a little bit more control over my schedule.

That will give me time to think more about my other personal goals, all of which are on the back burner until after tax day. The "usual suspects" are all in play--decluttering, professional education, and (new recently) doing some personal non-financial retirement planning (as in, what do I want to do with my life when I no longer have a job, a scary prospect for someone as work-identified as I am). That's part of the motivation for the Texas trip as well--we'll be doing outdoor activities in the mornings, but there's a "vision workshop" on one of the afternoons that I am very much looking forward to.

Posted in

Goals,

$$ balances,

Fitness

|

4 Comments »

February 26th, 2025 at 01:40 pm

This is the message today when I check my credit score on one of my credit card sites. It actually shows the esteemed 850/850 score.

This validates that my aggressive debt payoff plan is working.

I'll have to figure which of the three credit agencies this is from. 850 is obviously the high score; the other two are currently 840 and 821.

In other news, I went for my annual thyroid ultrasound yesterday. I think this is my 7th year of doing this. Anyways, I have a large (5 cm) nodule on one half of my thyroid and a smaller (1 cm) nodule on the other. I did have it biopsied back when the nodules were first discovered, but they came up with results that are "indeterminate." Because of this, I was advised back then to have a hemi-thyroidectomy--that is, to remove the half of my thyroid with the large nodule so that they could biopsy it to assure themselves that it is not cancerous.

I did some research at that time, and, while many people do fine after such an operation, there's a significant minority have to start taking thyroid medication (for the rest of their lives) and who claim that they just don't feel the same after the surgery. Also, there are now other procedures (e.g. radiofrequency ablation, or RFA) that shrink the size of the nodule. Because the nodule is so large, they tell me that further biopsies are not warranted--it would be a hit or miss game, with too high a chance of missing a potential cancerous spot.

Every year after the ultrasound, I have a consultation with a surgeon, who again advises me to have the operation because it is "the standard of care." After I found out about RFA and asked her about it, she now admits that RFA may well become the standard of care in a few years. So I tell her that, so long as the nodules are stable, I am not having half of my thyroid removed. (They can't remove just the nodules; it's either half or the whole thyroid that goes. Also, the thyroid is key to your metabolism; it affects every other part of your body and you use it for your whole life. It's not like a "female part," which, as a post-menopausal woman, I would not particularly be relying on at this stage of my life.) I will continue to monitor my thyroid annually with the ultrasound and if there IS significant change, I will have the recommended surgery.

In any case, the form of thyroid cancer that I am at risk for is slow-moving, and my ultrasound results indicate a "low suspicion pattern." (There are also very low suspicion patterns, so mine is not the least risk, but still low risk.) If RFA ever does become the standard of care, I will have it done. In the meantime, I feel relieved that I can expect to avoid this surgery for another year.

Posted in

Uncategorized

|

5 Comments »

February 9th, 2025 at 07:38 pm

So my last entry was on New Years Eve. What I didn't mention at that time was that I lost my planned PTO days of December 30 and 31, which I usually devote to year-end catch-up and planning, to a last-minute change in our computer systems by the company that acquired us. I got the morning of the 30th off, but because my work is so busy at the beginning of the year, I couldn't wait on upgrading my computer, so I lost half of the 30th and the day of the 31st to working on technology upgrades for work.

It's now February 9 and I'm still feeling annoyed about that. My job is so busy at the beginning of the year that whatever time I have off is just lost to catching up on R&R. Even if I have time, i don't have the mental energy at the beginning of the year for any decision making. So just color me annoyed.

So, what's been happening in Dido's world YTD?

Well, I''m happy that I received a 5% raise and a bonus of about 14% in January. Those just appeared in my pay without any communication from the company. Very nice to have, but yet another failure of communication.

I had accrued a little bit of debt on my HELOC the end of the year, which is not unusual--there seem to be more expenses and little additional income then (while in comparison, near the beginning of the year, there's usually a bonus from work and a tax refund). So I was able to pay off the HELOC and some other debt. My total debt currently stands at around $43,500 (of which about 24.5k is my mortgage; the rest is either loans or one 0% balance transfer card ($4k) where the rate expires in June.

My HELOC's 10-year draw period expires in November. I will need to talk with the issuing bank (which also holds my mortgage and my checking and savings accounts) because I foresee needing funds in the not-too-distant future to fix up my house. While I have some projects (more cosmetic than structural) planned for post-retirement to increase the eventual sales price I can ask, I have one project that is planned for this year. My neighbor and I share a concrete staircase in the front that has been crumbling for a decade. Every spring, our neighbor Jim (two doors down from me) patches it up, but the erosion is steady. Additionally the stairs are uneven and some of them are as much as 1.5" higher than the current code. (In fact, I'm really not quite sure why the city hasn't required any change in the stairs during the past few sales--2020, 2010, 2005.)

So I went into a local bank yesterday where I maintain a checking account because this bank is known for good rates and service, and I talked with a banker. Now of course, rates depend on the rates set by the Fed, but I can currently get a fixed rate loan for the stair project at 4.99%, and a HELOC with *no end to the draw period* currently for 1.99% for the first 6 months and the rate currently at prime + 0%.

So I've pretty much decided to do that, which will require that I close out the current HELOC. Then I can apply for the new fixed rate loan and LOC in the spring. Before closing the current HELOC, I need to see if I will lose anything (like free monthly fees on my checking and savings accounts or my free annual safety deposit box fee if I do that)--but I'm pretty sure that the only thing I would lose is that I'd need to start paying a $75 annual fee if I want to keep the SD box. And I'm really better off getting a home safe for the papers and old family photos that I keep in there.

The thing I'm thinking about now is whether I pay down the 0% balance transfer credit card early. I have the $4,000 in my brokerage account thanks to the bonus, invested in a money market fund earning around 4%. Since the pay-off date isn't until June, I was planning on just paying it down by $100 a month in the interim, using my March dividends to pay down a little more, then paying off the remaining balance (projected to then be $3,300) in June. Paying it off will boost my credit score, but I'm back over 800 (818! higher than I recalled). I might do that in the near future since it takes the credit scores a couple of months to catch up with the actual balances and because it would bring total debt down under 40k and consumer debt down under 15k - until the money is spent for the stair project (which would count in the housing debt rather than the consumer debt column).

I still need to plan for other upcoming expenses--I need to do my estate plan this year, I want to hire someone to help me do some decluttering this year (to ensure that it actually gets done), I am contemplating a trip in June to Texas with a women's group that I have been involved with online, plus I need to decide how I am allocating my "fitness dollars"--currently paying for weekly online fitness coaching for Q1 that I do "live online" to ensure that it gets done. Plus I would love to feel that I am ready to adopt a new pair of kitties by later this year. I need mental space for that planning, which I really don't have right now.

Other than that, I've been obsessing about the current political situation, doing jigsaw puzzles, training for another online 5k on 3/1 (I already did one on 1/1 and a baseline for the 3/1 "race" on 2/1), working with an online personal trainer once a week, and taking an online weekly meditation class. And work. Endless work. Gotta get back to it now!

Posted in

Uncategorized

|

4 Comments »

January 1st, 2025 at 01:39 am

Still have to wait for the final 12/31 numbers, but they should be close and I'm rounding in any case. Total assets, around $1,070,000 (high in November was $1,085,000). Added around $129,500. Total debt, around $50,750, a significant decrease of about $23,500--a big improvement over my typical $10k decrease a year. Motivated in part by the acquisition of the company I work for, which lit a fire under me for getting debts paid off just in case I don't like the way things go under the new entity (which, since we were acquired by a private equity firm, will probably be sold again in another 3 years). Total net worth around $1,019,250--first time I end the year over a million.

I have two beneficiary IRAs which operate under the "old" (pre-SECURE Act) rules, so I have annual RMDs (required minimum distributions) to take. While I have the debt, I have been taking my RMDs near the beginning of the year and using them to pay down debt. I will do that again this week. After that, I expect the total debt balance (around 25k of which is what's left on the mortgage) to be down to around 44k).

We may or may not get a bonus--I still have no good idea how the new acquiring company works, other than that if there IS a bonus, it will come early in the year, along with an announcement of raises (again, waiting with great anticipation). With my old, much smaller company, they kept the employees apprised each month of how the company was doing, so we had a pretty good idea of whether bonuses would be coming or not, since bonuses were based on the company meeting a certain profit margin. In any case, if there IS a bonus, I have one additional chunk of debt (a balance transfer credit card) that I will pay off and then will add the additional funds to a sinking fund for all of my "irregular" annual expenses.

I plan to manage things a bit differently this year--in the past, I've paid the credit cards down to a certain balance (typically, three with a $500 balance) and as long as I paid off the prior month balance, I didn't incur any interest charges. In 2025, I plan to leave the base balance at zero rather than $500 on those 3 cards. As the debt is coming down, I will be adding the excess to a government money market fund in my brokerage account for those big sporadic expenses, like annual insurance premiums. I hope to build that fund up over the year--but whether or not I am really able to build it up depends on whether or not a bonus is forthcoming. With no bonus, the additional funds I add in to the sinking fund will be spent during the course of the year.

As for my annual goals: I kept up the exercise at the beginning of the year and have been getting back to it during Q4, but the middle of the year was kind of a lost cause. I did NOT run the planned Turkey Trot again but will plan to run it in 2025. I also gained back about 10 pounds. Not a great year for my health goals, but it could have been worse. Wealth goals are right on target (as revised mid-year). My systems/habits/routines goals did not have much progress. If we do get a bonus, my big plan is to hire some help for the decluttering. I think that's the only way to ensure it gets done before I retire. The other thing I will do is to re-organize my vacation days, which I have been using to take long weekends, but it's been 2 or 3 years since I had as much as a whole week off at a time. One nice thing about the new company is that I will get an additional 5 PTO days, and I will plan to take perhaps a couple of 2-week periods of time off to make some progress. The problem with lots of long weekends is that the order in which I address my needs when I have time off is to first, catch up on rest, then to catch up on my social life, third to catch up on chores....which leaves no real time for any project that might take longer, like clearing out the items I don't use from the kitchen cabinets or sorting and filing the research papers I collect. In any case, Goals for 2025 will essentially be my 2024 goals updated, which is pretty much how it always works, now that my education and career change goals are history (but they were very much what governed me during my early days of blogging here).

Well, it's all of 8:30 pm on New Years Eve and I am pretty much ready for bed. I've been watching a lovely little series called "Portait Artist of the Year" on Amazon Prime (10 seasons available; they also have 8 seasons of "Landscape Artist of the Year"). It's just the right pace for a pre-bedtime winddown. Happy New Year everyone!

Posted in

Uncategorized

|

7 Comments »

November 1st, 2024 at 12:58 am

I've been focusing on decreasing my debts this year. So far I've paid off $23,250, and I'm within a thousand of my (revised) year-end debt goal of a total under $50,000. (The goal was 60k at the beginning of the year but a surprise bonus when the company I work for was acquired allowed me to pay down more debt than I had expected.) Of that, the mortage will be $25,760 after the monthly payment hits tomorrow. I should reach the $50k goal sometime during November and am currently projecting the year-end total debt at $48k.

Hopefully assets continue rising, although I'm definitely expecting some volatility with the election next week (I'm not expectingthe winner to be called on Tuesday, although if there were enough certainty with the Electoral College votes to call it by then, that would be great.)

Traditionally, November and December are the strongest months of the year for the market, but we'll see how that plays out this year.

Whichever candidate wins, there will be ramifactions for the markets and for taxes, but typically the reaction around the election itself is short-lived. It's the policies that matter more in the long run.

And as for policies, the President generally can't act alone; the results of the Congressional races matter, as do judicial reviews. One thing that surprised me was an article in The Economist (this week's or last week's) showing that a "trifecta" outcome is actually more likely than a split party decision.

Whichever way the election goes, I'm looking forward to getting rid of that debt in the next 3-4 years and starting to build a buffer for myself of at least one year's living expenses in safe investments in a brokerage account. Right now there's only about 1.5 months' worth. I've got about $11k worth of loan debt that will be paid off in 2025, and, as those loans mature, I should be able to divert most of the payments towards brokerage account savings (except there's one big home improvement project that I will need to fund as well.)

Posted in

$$ balances

|

4 Comments »

September 27th, 2024 at 11:54 pm

Patient Saver and I "met" on this blog back in 2006, the year we both started our blogs. We connected here due to similar attitudes, similar ages, similar things happening in our work lives (layoffs and transitions).

The first time we met in person was in 2011, when I was driving home from a relative's wedding in Massachusetts. We met at a highway rest stop, had lunch, and took a walk where she showed me some of her town.

There have been a few visits over the years--I think I've stayed over at her house once, maybe twice, and we found a town about half way in between us and have met there several times (most years but not every year).

The past several years, both of us had elderly cats with medical conditions, so that meant that our visits were daytrips centered around sharing lunch and a walk.

But when I read that PS had lost her beautiful Luther, I thought that the time might be ripe for her to visit me, and she agreed.

This week worked well with my work schedule since the people who I work for were otherwise occupied this week and I had no client meetings to prepare for.

Unfortunately I could not fully play hostess as my home is currently too cluttered (bad me). I usually have an annual visitor over the summer and get the house cleaned up for her, but that visit did not occur this year. I knew that, with the scheduling, I wouldn't be able to clean up entirely, but I did get the downstairs and bathroom presentable. We split the cost of her stay, with her covering one night and me another.

PS arrived on Wednesday. I took a long lunch break and took her to lunch, then drove her to my office and set her loose on downtown Historical Bethlehem with a map and guidebook. I scheduled dinner at the historic Hotel Bethlehem (winner of the best historic hotel in the United States four years in a row) in their gorgeous

dining room. Unfortunately the history museums were closed, so PS mostly saw the outside of buildings, but we did get to stop inside the Sun Inn Tavern (George Washington really DID sleep there)

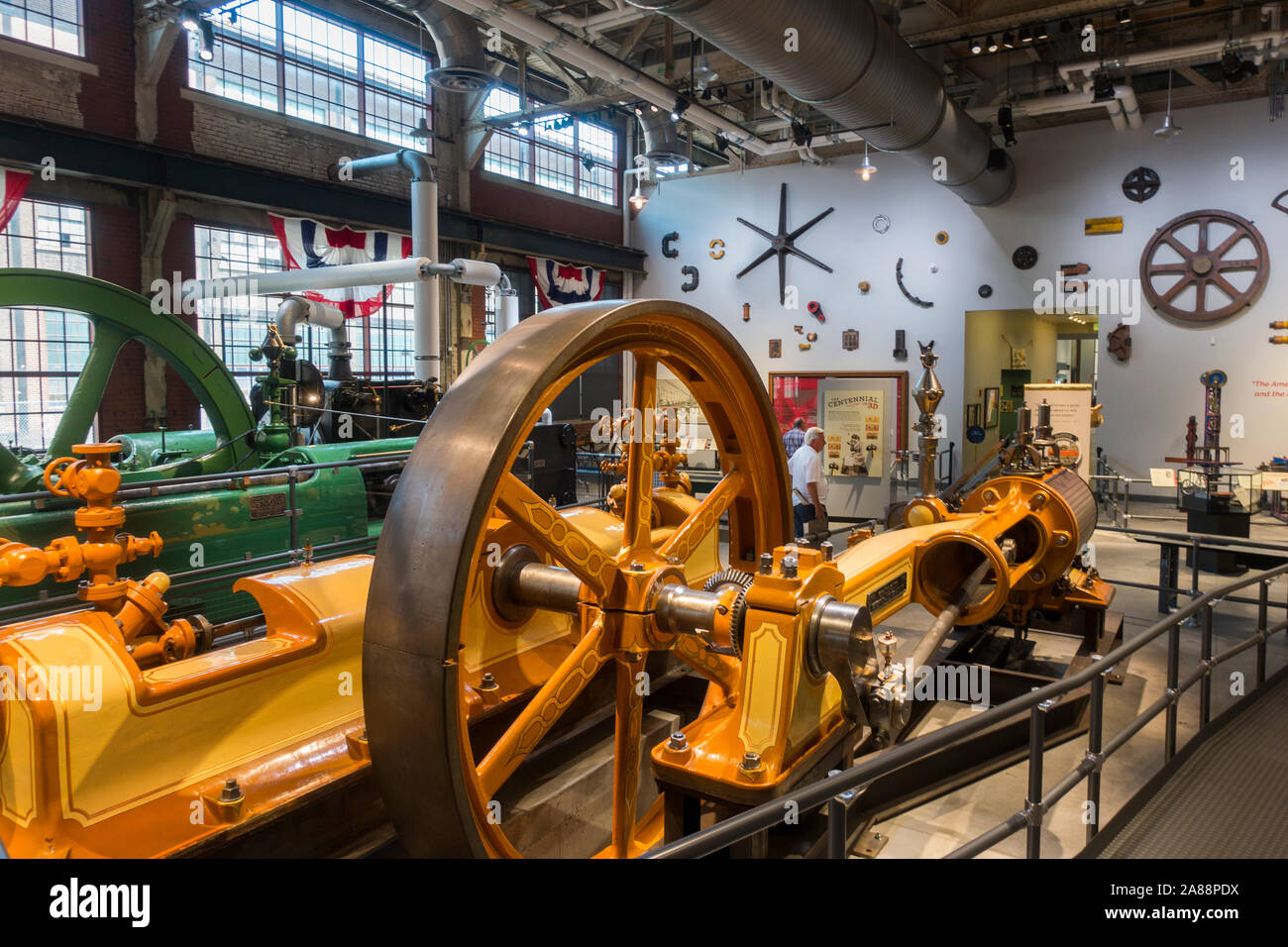

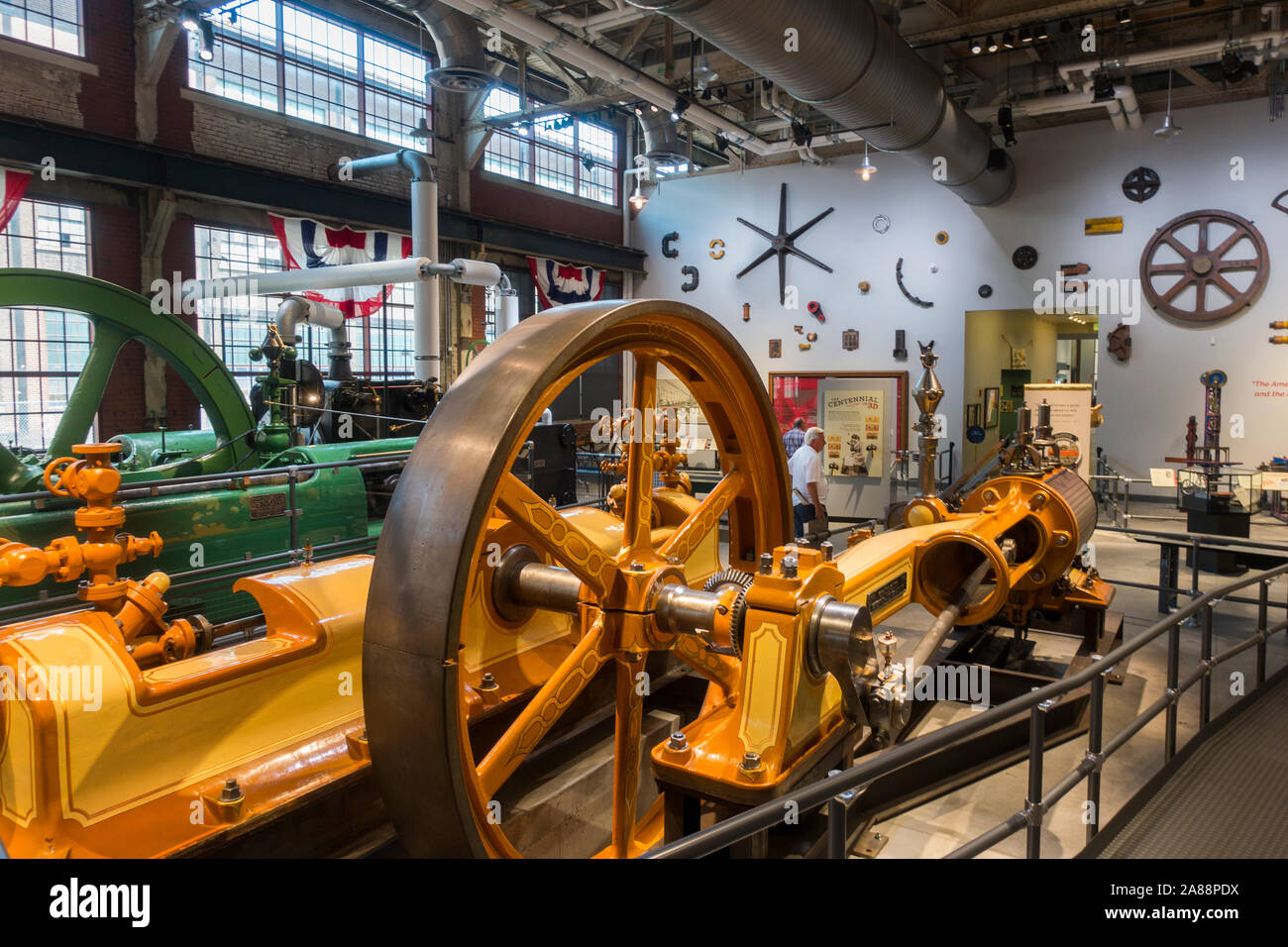

I was able to take Thursday and Friday off work. Bethlehem has distinctive north and south sides (they were once separate cities). Since we had focused on north Bethlehem for the first day, on Thursday, we started off with South Side Bethlehem, first at the Banana Factory, which has art galleries and classes and artist's workshops, then driving over to SteelStax, where the old blast furnaces of Bethlehem Steel play backdrop to a new (decade-old) performing arts center and the Visitor Center for South Bethlehem. We visited the National Museum of Industrial History  (affiliated with the Smithsonian) and walked the Hoover Mason Trestle, which is a half-mile elevated walkway along the side of the furnaces. After stopping for lunch at a Korean restaurant over in Easton, we took the mule-powered canal boat ride on the Lehigh Canal, giving us a full view of how the canal and steel industries paved the way for the takeover of the railroad industry. You certainly see industrial history in this area, from the nation's first city pumping system from the 1760s to the Ben Franklin Technology Partners, which brings together science and engineering expertise from Lehigh Univesity and Lafayette College with business expertise from those same colleges' business programs and local venture capitalists. (affiliated with the Smithsonian) and walked the Hoover Mason Trestle, which is a half-mile elevated walkway along the side of the furnaces. After stopping for lunch at a Korean restaurant over in Easton, we took the mule-powered canal boat ride on the Lehigh Canal, giving us a full view of how the canal and steel industries paved the way for the takeover of the railroad industry. You certainly see industrial history in this area, from the nation's first city pumping system from the 1760s to the Ben Franklin Technology Partners, which brings together science and engineering expertise from Lehigh Univesity and Lafayette College with business expertise from those same colleges' business programs and local venture capitalists.

After PS checked in to her AirBnB and we each had a short rest, we reconvened for a light dinner at my house, since lunch had been quite filling.

Friday morning, we met for breakfast at the cafe in my neighborhood and around the corner from the AirBnB where PS was staying. This cafe is one of a dozen or so in the US affiliated with "One World Everybody Eats," a nonprofit organization. All of these cafes are built on the model that you "pay what you can." You order and you are given a suggested price; if you can, you donate additional money, and those who are down on their luck can get a decent free meal in a charming location. Since PS wanted to take off for home leaving by noon, I decided that the best use of our time was a tour of the western half of the Lehigh Valley, with a stop at the Allentown Farmer's Market  and, along the way, a drive past the mansions of the Saucon Valley and a look at downtown Allentown, the largest city in the area. and, along the way, a drive past the mansions of the Saucon Valley and a look at downtown Allentown, the largest city in the area.

It was fun to play tour guide and also to have more extended time for conversation. Since I first visited PS's home perhaps a decade ago, it was nice to have the opportunity to play host for a change.

Posted in

Uncategorized

|

3 Comments »

September 20th, 2024 at 03:39 am

Just a note that I hit a financial milestone today that I want to remember, courtesy of the financial markets. I will probably drop below this number again, but I've found that, once a milestone is attained, it is likely to "stick" after a few months, especially since I am still in savings and paying-down-debt mode.

There are other financial milestones I want to hit before I shift gears and move from accumulation mode to distribution/decumulation mode.

But for today I will just revel in having attained a number that I have been focused on attaining for a long time.

Posted in

$$ balances

|

4 Comments »

September 1st, 2024 at 01:25 am

Net worth is now around $989,400--so I'm expecting to hit a million this year at last.

With the company acquisition, we have all new benefit plans--same benefits essentially but different custodians.

I spent a couple of hours setting up my new 401k. It's annoying that my old company managed the details of the allocation for me--all I needed to do was to pick a target risk allocation and they'd do the specifics, while I need to manage the allocation for the new plan.

I used my old plan allocations as a rough guide to set up the new ones, but there are some categories of investments--TIPs, dividend appreciation funds, and foreign bonds--that are not available in the plan options for the new 401k. That is especially annoying about the dividend appreciation category, as I like to split the US equity allocation largely between index funds and dividend-oriented funds. It took me a couple of hours of digging into the new plans options to figure out an allocation.

One good thing was that the new plan site has a calculator that allows you to figure the effect on your take-home income and taxes of varying allocations to the traditional 401k vs the Roth 401k option. For the past couple of years, I've been contributing 10% pre-tax and 10% Roth. The calculator allowed me to figure that contributing 18% to the Roth (and none to the pre-tax) should yield the same take-home pay. So that's what I set the new allocation to, with a goal of increasing the allocation back to 20% (all Roth) in January.

Debt is on track to be down to 50k or lower by the end of the year, which makes me happy since it has been mostly between 75k and 90k for the past few years. I have no idea if we'll get any bonus in January, which is when the new company issues bonuses--that bonus I got upon the close of the deal might be my only bonus until January 2026. In any case, I have some inherited IRA accounts which have RMDs, and I have been using my RMDs to pay down debt, so by sometime in January, I expect to get debt down to 45k or so. I am expecting an expensive home project next year, so I'll have to set aside some money in January for that.

Financial independence isn't yet here but it is definitely beginning to come into view!

Posted in

$$ balances

|

0 Comments »

August 31st, 2024 at 04:39 pm

So last Saturday was my birthday. It was lovely to have it fall on a Saturday so that I had the day off! Too many times in recent years the company president schedules a trip to PA during the week, which makes it extra busy. He *was* up the week before, but all the extra busy-ness was over by the time my birthday arrived.

I took last Friday off (as I have been doing for much of the summer) and went to an AirBnB within about an hour's drive--just far enough to really feel "away" but not so far that the drive was stressful. (I pretty much stopped driving distances during the pandemic. Since I work a mile from where I live, most of my driving is within a 3-mile radius of home, and maybe once a month, I'll drive to a nearby town and go about 10 miles away. Driving 50 miles or more has thus become a stressor that I tackle about once a year.)

Where I stayed was on a historic Amish homestead, the Nicholas Stoltzfus family home. It turns out that everyone in the US with the last name of Stoltzfus is descended from the former owner of this property.

The original homestead is still there and I was given a private tour by the caretaker. (The property is owned by a non-profit group, and a couple with the last name of Stoltzfus are the current caretakers. The AIrBnB fees are used to support the upkeep of the property.) Where you stay is in the reconstructed barn. The caretakers live on the first floor of the barn, and the unit they rent is about 1/3 of the second floor of the barn. The other 2/3s of the second floor is rented out for meeting space. The property is built on a hill, so even though it's on the second floor, there are no stairs to climb.

Where the property is located is actually very close to the highway, but you have to drive down a long roadway, past a local Penn State campus and the campus of a retirement home, before you get to the property. Then the deadend of the road due to the highway (built about 30 years ago) is just past the end of the property. The caretaker showed me a map--when they were building the highway, there were eight different alternate routes they considered using, several of which would have gone right through the property--that's when and why the nonprofit was formed. And the owner of the retirement community next door (the son of a former state governor) was helpful with the funding needed to save the property from being destroyed. The current caretakers will be pursuing getting the property put on the national historic register soon--it's not there yet.

Right across the road is a creek, and a four-mile long towpath that runs along it. There's a Park Ranger house a quarter-mile away, so the towpath feels very safe. (That's especially nice because, since the pandemic, my current city has allowed a homeless encampment to occupy a large space alongside the towpath near my house, so I no longer feel safe running and walking there by myself, something I have done for nearly 30 years.)

Since check-in was at 3 on Friday, I got there shortly after and, after checking in, went to the nearby Pennsylvania Dutch Farmers Market to pick up dinner. We have a Farmer's Market locally that is similar (and similar to Reading Terminal Market, if you have visited that in Philly). This Farmer's Market was smaller and exclusively run by Amish and Mennonite stallholders, unlike the larger Farmer's Markets. I picked up a pint of chicken salad, two pre-made vegetable salads, a gluten-free peach pie and Whoopie pie, and a few peaches for my stay.

The drive had fatigued me (the stress of driving), so I went to bed early. On my birthday itself, I had my tour of the historic home and then visited the Ephrata Cloister in the afternoon. I had heard of the Ephrata Cloister previously but had not visited. This is the remnants (about 10%) of the original community from the 1700s which was started by Conrad Beissel, an Anabaptist minister who founded his own sect, distinct from the other Anabaptist groups by virtue of two beliefs: 1. The Sabbath should be celebrated on Saturday; and 2. The return of Christ was imminent, so that believers should shun wordly marriage and dedicate themselves soley to Christ--in other words, be celebate. Not a recipe for a long-standing religion! In actual fact, the community consisted of Brothers, Sisters, and Householders. The Brothers and Sisters adhered to all the beliefs, while the Householders were married couples who believed in some but not all of the beliefs of the community and helped with economic support. The Brothers and Sisters slept for only 6 hours a night--from 9 to midnight, and then from 2 am to 5 am. From midnight to 2 am, they had a night watch service, since it was Beisel's belief that Christ would return during that time.

The community was also unique in fostering several women composers. The Ephrata Chorus still continues today. They also produced a unique style of calligraphy called fraktur used for making posters of religious phrases or important personal papers.

I did go out to dinner for my birthday, finding a Japanese restaurant nearby and treating myself to a rice bowl.

On Sunday, I went for a 3.6 mile walk/jog along the towpath, and stayed on the property until 1 pm (an extra two hours allowed me by the caretakers) before driving home.

Staying here was about $75 cheaper for a two-night stay than the Bed and Breakfast in the Poconos where I usually stay (although, unlike the B&B, there was no breakfast included). While I had to provide my own food, the fact that the property was only about a mile from the Farmers Market pretty much compensated for that. The area is busier and noisier than the Poconos since it is in the middle of a city, but, while I won't give up on my other B&B (which sits right along the Delaware River), I'll also add this place into my regular rotation of spots to visit for a weekend get-away.

Posted in

Uncategorized

|

2 Comments »

August 17th, 2024 at 06:32 pm

Well, the company I work for was acquired yesterday. Our name and the website change on Monday. We'll be getting new computers too--instead of a regular PC with the ability to log into a virtual desktop from a device at home, I'll get a laptop and will need to lug it home or elsewhere if I want to work other than onsite.

The new company has different health insurance and different 401(k) plans, so there will be a lot of administratrivia and paperwork changing those. I can roll the current 401(k) over to the new one or roll it to an IRA. They're also closing our cash balance pension plan and issuing us a check for our accrued balance--I have the same options for that as well.

The new company has all employees paying a share for their health insurance and their vision and dental benefits cost a bit more. They're adjusting my pay to make me whole on that.

The company I've been working for is a smallish (22 employees) family-owned company. The new company is actually an entity formed by a private equity group that has been on a campaign buying up independent RIAs (Registered Investment Advisors)--I believe we are the 7th acquisition since 2020. Whereas I know, to at least some extent, all of the other employees at my current firm, I doubt I'll ever know all the other employees with the new firm.

Since the old company was small, our COO was in essence our HR department and we had an employee, not a lawyer, who handled SEC compliance. The new department has an official HR department and a team of lawyers to handle compliance issues. The merger gives us a better answer when clients or prospects ask about the firm president's succession plan (not that he is planning on retiring anytime soon). We'll also get better service from the asset custodians, since advisors are assigned a level of service that is based on AUM (assets under management).

The new firm is headquartered in Boston, so we will all be taking a trip there in a month. Boston is one of my favorite cities so it will be nice to see it again (for however much time we have to see things during a 3-day work retreat).

To start, there are supposed to be fairly few changes in our day-to-day experience since the main goal is to keep servicing our current clients in the way they have been accustomed to. But we'll see what happens over time. I can't deny that the change makes me nervous. It could be a good thing, but perhaps not. And while I've definitely felt that I have had influence over certain things like the choice of tax-planning software with my current firm, I don't expect to have that kind of influence with the new firm (EXCEPT that the plan is to move the aquiring firm over to the tax planning software that we use). But who knows if I'll have that kind of influence again?

One good thing is that the owners of the old company gave each of us employees a very nice bonus upon the close yesterday. When I saw the net amount in my checking account this morning, I paid off my highest-interest debt in full and paid down some of the next highest debt. Total debt (including mortgage is now down to about $53k--and before learning of the bonus, my year-end goal had been to get it to $60k). That accounts for about half of the bonus, and the other half I will be putting into savings in my brokerage account to have more of a buffer for future expenses.

In other news, yesterday the gas company moved my meter from indoors to outdoors. They may have cracked my foundation in doing so. I wouldn't have noticed, but I recently became Facebook friends wiht the former owner, who asked me about the crack when I posted a picture online yesterday. I have no idea whether that was there before or not. So there will be that to deal with.

Posted in

Uncategorized

|

6 Comments »

August 2nd, 2024 at 03:52 pm

I couldn't help myself. I did something I know is irrational.

When checking my mortgage balance this morning, I saw that $43.24 remained to the next thousand-dollar incrediment.

I had over $13 in rewards on a credit card at the same bank, so I applied $13.24 to the mortgage and then paid an additional $30 from cash to get the mortgage balance to $27,000 once all the payments settle.

I also have $8,500 on a HELOC, so total housing related debt is $35,500.

The HELOC interest rate is more than twice the rate on the mortgage, so I should have applied the extra payments to the HELOC, but I couldn't help myself--round numbers have a definite allure.

It's how I've accelerated my mortgage payments ever since first taking it out in 2005. I've ALWAYS rounded the balance down to the next hundred by paying extra towards principal--until interest rates skyrocketed, and then I rounded the mortgage payments down to the nearest $10 so I could apply more payments to my debts that have higher rates.

Current TOTAL debt is about $61,500 with about $14,300 (including that HELOC) at rates over 6%.

The higher interest debt will be refinanced in October at lower (not low, but lower) rates. I'm assuming that the Fed will cut rates in September, which should lead to a bit of a drop in loan rates, and I have more "hard checks" on my credit score than I should due to some credit card fraud I experienced in February. I caught the fraud right away and notified the agencies, but none of them have taken the false "hard checks" of my score. I did have a "real" hard check from last October, which should roll off mid-month and improve my score a bit more. If I had time and energy to deal with the credit card agencies, I would, but I don't. It's just easier to wait and have a plan.

My goal at the beginning of the year for year-end debt was $60k. I should actually get there either this month or next.

Then projected year-end debt is $55k as long as there are no more major repairs or appliance replacements.

Then January should lead to further decreases still due to a bonus, plus I apply my beneficiary Required Minimum Distribution from my inherited IRAs to debt reduction at that time.

My total debt (which maxed out at $108k in 2011, the year my mother died and I was both employed only part-time AND flying out frequently from PA to CA) hovered at around $90k for several years, and only recently started decreasing significantly once my salary increased to a certain level. Debt reduction improved more (unfortunately) with the lack of pet expenses since last May. There WILL be cats again, but in the interim, it is helpful to see my total debts going down, and especially down to a small fraction of my assets.

Posted in

Uncategorized

|

3 Comments »

July 24th, 2024 at 01:06 am

No posts from CB in the City since June 30th. I hope you are doing ok!

Posted in

Uncategorized

|

4 Comments »

July 17th, 2024 at 05:44 pm

My portfolio hit over 800k. It hit the 700k mark back in December 2023, so just over half a year to gain another 100k (including my contributions). I doubt the second half of the year will be as good.

My total net worth (including assets and debts beyond just the portfolio) is up over 110k so far for the year--a record increase.

Debts are down to near 63k--they were at 69k in February. I am really working on paying down the debt this year. That's why I am delaying acquiring more cats. I had thought at the beginning of the year that I would get two new rescues over the summer, but then when I realized how much more quickly the debt is coming down without the additional pet expenses, I decided to delay.

Knock on wood and we'll see what happens with the markets, but I'm pretty sure my total net worth will hit a million during the second half of the year. I will feel like I am "financially independent" when the *portfolio* (not the total net worth, just the investments) is around 1.25 million. That should come within two to four years as I am saving fairly agressively--20% of my salary, plus at minimum another 3% from my company, and most years a profit-sharing contribution from the company that's aboout another 6% of my salary.

Before I retire, I also probably should pay for a couple of big home expenses (redoing the concrete stairs, which needs to be done in conjunction with the neighbor since we share a twin structure and one staircase leading up to both porches--and I should redo the roof too, plus buy another car (my current vehicle is 12 years old, but with only 66.5k miles), so there are those factors too to factor into the equation. The neighbor and I have talked and are planning to do the stair project next year.

Also, talking of roofs, did you know that insurance companies are really weighting those much more heavily these days? If your roof is over 15-20 years old (depending on the company), they are likely to raise your rates. EVEN if you have 50 year shingles--it's the actual age of the roof, not the manufacturer's guarantee on the materials, that matters. Also companies are now using drones and computer imaging software connected to satellites to check on roof condition. You can find some of this online--I found a site back in May that used satellite imagery to show me a picture of my roof and the measurement and give me an estimate of replacement cost--but the insurance agencies have access to even better software that allows them to zoom in even more. (My firm had a property & casualty insurance broker in to do an educational session with us on Monday and this was a key take-home point.)

Still, I am feeling like "FI" (financial independence) is finally within sight, at least. Not close, but at least visible on the horizon.

Posted in

$$ balances

|

5 Comments »

July 1st, 2024 at 02:15 am

Total Assets are staying north of a million (first reached 2 months ago). Up 8.2% YTD.

Total Debts are down 13.4% YTD.

Total Net Worth is just over 950k, up 10.1% YTD.

Not quite to the point where I feel "financially independent" (that is, free to live off of my assets rather than off of my income) but getting there!

We hade a short but severe windstorm mid-week that took out power for two days; I had to toss about $100 worth of food. Temps have been in the 90s and it's been so humid that my glasses fog up as soon as I step outside.

I did go kayaking for the first time this year yesterday. It was pretty windy out there still!

Posted in

Uncategorized

|

2 Comments »

June 21st, 2024 at 08:52 pm

I've been meaning to get my strength training going again, so I had been looking at Planet Fitness (which I belonged to for 6 months of 2022, as a "Black Card" ($25/month) member. Then yesterday I happened to catch an online discussion that suggested that PF was about to raise their prices. I did my own research and confirmed it.

Fortunately the deal that was offered to me yesterday was better than the last one I had seen (no commitment, only a $1 joining fee rather than the usual $49 joining fee), so I rejoined yesterday for $1 down. The first $10 monthly fee will hit on 7/17, and then there IS a $49 annual fee that will hit in September. The $10 price remains as long as I don't let the membership lapse.

But still for $120 ($10 * 12) (+ tax) + $49, I consider this a $169/year "health insurance policy." The gym is only 6 minutes from home, it's clean, the equipment is maintained, and I've never gotten sick after working out there (which is something I cannot say about the many other more expensive gyms I have belonged to over the past few years.

The downside is that they currently do not have a personal trainer on staff (which they typically do). I would like to learn proper form for doing deadlifts with barbells, using the squat machine and the cable machine...but in the interim, there are all the other machines I have been using for years to start with. I know intellectually how important it is to maintain strength, but for the past year, I've focused on walking and running and haven't done much strength training at all, so I hope to change that.

Posted in

Uncategorized

|

0 Comments »

June 14th, 2024 at 01:07 pm

It's been an eventful month, but more of an inflection point than a sea change.

Probably the biggest thing that happened, but one that doesn't affect me personally, is that my cousin's wife, who has been part of our family for over 30 years, had a heart transplant. When we got together last month, she told me she was on the transplant list and had been for a while, but we were all surprised that the right match came for her just two weeks later! She was in the hospital for about 10 days, was up walking within 24 hours of the surgery, and is doing well, with a much healthier heart than before! (She is a cancer survivor, and drugs from that previous medicl event damaged her heart.) So that is a great blessing.

Personally, there are some changes happening at work. My job has been remarkably stable for the past 6 years, and this is the first time since 2018 that there will be some changes. Now change can be good or change can be bad, and I pray that this is all to the good, but it does make me more eager to reach "financial independence," (FI) the point at which I have the ability to support myself from my savings rather than my income, and when I work because I WANT to rather than because I HAVE to. We are at the point where the changes have been announced but not yet implemented--that really comes starting in mid-August.

And of course, it's a basic principle of psychology that we get more motivated and strive harder the closer we are to achieving a goal.

The speed with which I reach my goal depends on the market, of course, but I am making progress. We aren't quite to the halfway point of the year yet, but to date, I have reduced my total debt by about 12k and my assets have increased by about 75k. (I put 2k a month into retirement savings, and I get one big annual "profit-sharing" contribution early each year from my employer, so about 1/3 of the increase is from funds added and 2/3 is from capital appreciation.)

All things taken together, I figure I am 2-4 years from FI.

I also have a home repair issue that I have been dealing with. I live in a 1915 house with a half-bath that was added on much later. When we have bad storms, it has been literally raining inside my house in the doorway in between the original home and the addition. I have four buckets that fill that doorway. I'm pretty sure that the problem has finally been correctly diagnosed and I have signed a contract for a repair, but the earliest the work will commence is the 20th, so I'm a bit nervous about the storm forecast for tonight, and I hope that is the only one before the repair.

The drywall in the ceiling of the half-bath has also been damaged and will need to be replaced (and probably mold remediation done), and my neighbor and I have agreed to replace our shared front steps next year--all of this will be quite pricey.

For the moment, I am holding off on acquiring new cats, as much as I want new companions. I am able to make greater progress on the debt reduction without having that commitment. Pets and books are my biggest spending indulgences--and the cost for pets far outweighs whatever I spend on books.

Other than that, I have been struggling for a couple of months with fatigue. The first quarter of the year is so busy and the worst of it is that the scheduling is out of my control, as I am a "sub-advisor," not a lead. I pushed pretty hard through Q1 and hit a wall sometime in April, at which point I've been spending more time going to bed early than working out. I did manage to run a 5k last Saturday, though (with a short walking interval after every mile), so I haven't totally lost my conditioning.

In any case, I went ahead and scheduled my PTO time for the rest of the year. Every Friday off starting next Friday, through the end of August. Then another two days (for a 4-day weekend) in early October and a final two days at the end of the year before the pressure starts all over again. (And there's also a 4-day weekend for Thanksgiving and a 3-day for Labor Day, so at least one long weekend every remaining month.) I am hoping that by having 11 3-day weekends in a row, I will regain some energy and also be able to make some progress on decluttering.

Also, my best friend turned 80 this week. Three of us from our congregation took her out to lunch yesterday, and we agreed to meet for lunch the second Thursday of every month. One thing that has happened during the past several years is that all of my close friends locally have retired, and I have been left out of much of the socializing, which has moved to mid-day. But they agreed to meet every month near my work (which fortuitously is on our local "restaurant row"), so it will be nice to add that regular socializing back to my schedule.

Posted in

Uncategorized

|

5 Comments »

May 13th, 2024 at 12:50 am

I went to Los Angeles last weekend--really a 5-day weekend from Wednesday to Sunday. I visited my sister, who lives in the house I grew up in, for the first time in 5 years, and also saw my one remaining aunt and one of my two first cousins on my mother's side and his family, as well as one high school friend.

I was fortunate enough to have company on the flights out and back. The trip actually came about because my supervisor at work has family in L.A. too, and she had arranged the trip for those days. She encouraged me to fly out with her and her husband because she knows I have a hard time taking vacations. So I had someone to talk to and watch my bags at the airport.